Keep your identity safe

In today's world, safeguarding your personal information is crucial whether you're navigating the digital realm or going about your daily routines. This involves using robust passwords for all of your online profiles and being selective about what items you carry around with you. Continue reading to discover which things shouldn’t be kept within your wallet.

Social Security card

Avoid this major mistake: Never keep your Social Security card or number within your wallet. As stated by Eva Velasquez, who serves as both the president and CEO of the Identity Theft Resource Center, "Your Social Security card and personal identification number hold immense value for criminals. Armed with these details, they could effortlessly submit tax returns under your identity, establish new lines of credit in your name, obtain healthcare services, or even engage in illegal activities utilizing your data." Should your wallet be taken along with your social security information, promptly inform the Social Security Administration about the incident.

Medicare card

Even if you're not carrying your actual Social Security card, your SSN could still be exposed through something far more commonplace—a Medicare card. In the past, old Medicare numbers were simply your Social Security number followed by one or two additional characters—making them relatively easy to decipher. According to Adam Levin, who founded Cyberscout, a company specializing in identity theft prevention and data security, and authored several books on these topics, it’s best to keep your card stored away unless you’re heading to a doctor's office for an appointment, thus minimizing the chance of exposing this highly sensitive information. Swiped . “All other days you make a Xerox copy of it, wipe out all but one or two numbers, and on the back write the [phone] number of an emergency contact,” he says. That way, rescuers will still be able to get the information they need during an emergency.

Receipts

Initially, a store or bank receipt may not appear to contain substantial details. However, an experienced criminal can leverage this seemingly insignificant information for more effective theft, according to Levin. As an example, someone observing numerous receipts from weeknight shopping trips at Target might choose to do their shopping on a Monday evening without raising suspicion with the credit card issuer. Alternatively, your credit card company’s support team might be more inclined to validate a fraudster who has knowledge of your most recent transactions. Moreover, scammers could impersonate your preferred eatery through emails containing links that install malicious software once clicked. "What reason exists for keeping data points which, if obtained by criminals, would provide them with another fragment of the overall picture?" asks Levin. "When unnecessary, refrain from discarding such items; instead, destroy them." Rather than accumulating physical receipts post-purchase, consider requesting digital copies sent directly to your inbox, or utilize applications designed to securely archive these documents electronically. Shoeboxed .

Membership cards

If you regularly save money at Costco or frequently visit the gym, congratulations! However, here’s an important caveat: Avoid storing your membership cards in your wallet. Should someone come across your wallet, they might use these cards to access both locations, adding extra hassle as you'd have to replace them later. Instead, consider leaving these cards in your vehicle where they're safer, advises Robert Siciliano, CSP, who runs IDTheftSecurity.com. "Typically, when heading to Costco, I drive," he explains. "So my cards stay in the car."

Gift cards

Similar to cash, there's no method for retrieving funds if you misplace gift cards. "It acts like a sitting duck," states Levin. "These might as well be cash since using them doesn’t require showing identification." Just as you would not keep large sums of cash in your wallet, avoid carrying numerous gift cards unnecessarily. According to Levin, only bring them along when you're certain you'll make immediate use of them. Discover more about this topic here. 12 things you should absolutely avoid packing in your handbag too.

Numerous credit cards

You have a credit card for your go-to department store, another for travel rewards like airline miles, and yet another for accumulating hotel points—your collection might seem endless. However, amassing numerous cards isn’t necessarily wise. Both Siciliano and Levin suggest limiting yourself to only two or three to minimize the threat of identity theft. Distributing your reward points across multiple cards means none accumulate enough value to be truly beneficial, notes Siciliano. Moreover, the greater concern lies with how many cards you carry: each additional card increases potential damages should a thief strike swiftly, explains Levin. Instead, he advises keeping just one credit card along with a debit card close at hand, storing others securely away from prying eyes. "Recovering all those lost cards promptly could take much longer than an hour and a half," warns Levin. By maintaining distinct sets of payment methods, you create layers of protection—as long as you refrain from using them indiscriminately for every purchase. Ten instances when using a credit card is unwise .

Your work ID

If your employee identification card allows you to enter the premises outside regular working hours, losing your wallet can pose a significant security threat since it would enable a potential thief to gain entry into the facility. This situation might land both you and your company in hot water, according to Siciliano. To mitigate this risk, he suggests keeping separate wallets—one strictly for weekdays and another exclusively for weekend use. Why do numerous stores not accept American Express? .

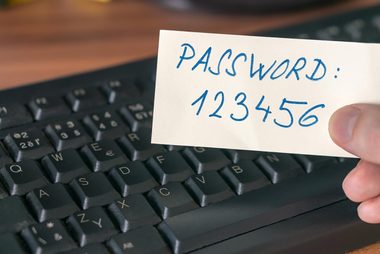

Passwords

Approximately 67% of individuals jot down their passwords on paper, as indicated by a survey conducted by the Pew Research Center. However, maintaining a continuous record of your passwords, PINs, and security codes within your wallet poses significant risks. As Levin points out, "It wouldn’t take someone longer than a few minutes to decipher those figures." He questions why anyone would willingly contribute to having their personal information stolen? Instead, Siciliano advises utilizing a password management tool available on phones or computers. This application keeps track of all your various complex passwords for each account, eliminating the necessity to remember them individually. Stay clear of such risky practices. Passwords that attackers are likely to predict initially .

Blank checks

Crooks can accomplish much more with an empty check than one might imagine. Initially, they can effortlessly forge these checks to gain access to your checking account, according to Steve Weisman, the author of Identity Theft Alert They might utilize the bank account and routing details provided on the check for electronic fund transfers, making the process quicker and more difficult to trace. It’s wiser to bring along just one or two checks when they’re needed, ensuring the others remain securely stored at your residence. This approach is recommended. 10 immediate actions to take if your wallet goes missing or gets stolen .

Spare keys

Be cautious about carrying extra house keys in your wallet—as this can be a clear invitation for criminals to enter your home, according to experts. Thieves only need to locate your address on your driver’s license to gain immediate entry into your residence. Instead, financial advice website Kiplinger recommends entrusting spare keys with friends or family members. Here are 9 minor methods to stop losing items forever—including your key .

Too much cash

Carrying a thick stack of cash might attract unwanted attention from criminals. It’s better to keep just small denominations like fives and tens specifically for urgent situations. In case your wallet stuffed with cash gets stolen or misplaced, immediately contact the local authorities. As Weisman points out, "Although recovering your wallet may not happen, reporting it aids in documenting the incident which can support you later if your credit card or personal information was misused due to fraud or identity theft." Ensure your funds stay secure by understanding these precautions. 18 secrets pickpockets won't tell you about .

Passport

Unless you're traveling across international boundaries, keep your passport in a safety deposit box or some other secure location. Even when venturing overseas, security specialists recommend making a photocopy of your passport and storing the original document in the hotel safe. Thieves could potentially misuse a purloined passport to pose as you for travels, obtain a duplicate Social Security card, or establish bank accounts, says kiplinger.com. Why you should always keep your old passports .

Birth certificate

The guidelines applicable to your passport should also be followed for your birth certificate. Keep it in a safety deposit box and use it primarily for important situations such as finalizing a mortgage or obtaining a new driver’s license. Additionally, Weisman recommends taking preemptive measures by copying all the items in your wallet beforehand, which can help you determine precisely what has been taken. Ensure you are aware of these additional precautions. 26 hidden truths that identity thieves hope you'll never discover .

Sources:

- Eva Velasquez, who serves as both the president and CEO of the company, Identity Theft Resource Center

- Adam Levin, who established CyberScout and penned the book, Swiped

- Robert Siciliano, CSP, who serves as the CEO IDTheftSecurity.com

- Pew Research Center Managing passwords along with mobile security

-

Steve Weisman, author of

Identity Theft Alert

- Kiplinger Unwise Items to Store in Your Wallet

Post a Comment