Investing in stocks is among the most intelligent approaches to build wealth , but stocks with multibagger The ones with true potential are the ones that can genuinely enrich you. I refer to these as monster stocks, and surprisingly, you might discover some beyond just the well-known tech industry.

My concept of an ideal growth stock is a company possessing strong economic and brand moats And this has been driving its stock performance for years and will likely keep doing so. Thanks to their strong competitive advantages and growth opportunities, these firms have the potential to create significant wealth for investors over an extended period. Below are three powerhouse stocks that could potentially turn into multi-baggers if held onto as long-term investments.

Where should you put your $1,000 investment at this moment? Our analysis group has just disclosed their insights into what they consider to be the 10 best stocks to buy right now. Learn More »

An experienced leader who has substantial protective barriers

If you own a Visa (NYSE: V) When using credit, debit, or prepaid cards, you might not realize that the brand behind the scenes—Visa—doesn’t actually provide those cards. Instead, they offer co-branded options where each purchase made through swiping connects you with merchants and various financial entities like issuers and banks via their payment-processing infrastructure. For facilitating transactions worth trillions annually, Visa levies fees on these processed payments.

For the fiscal year 2024, Visa’s network managed approximately 310 billion transactions internationally through both card-based and cash transactions, amounting to an impressive $15.9 trillion. Currently, Visa stands as a premier player in payment processing globally, boasting around 4.7 billion cards in circulation worldwide.

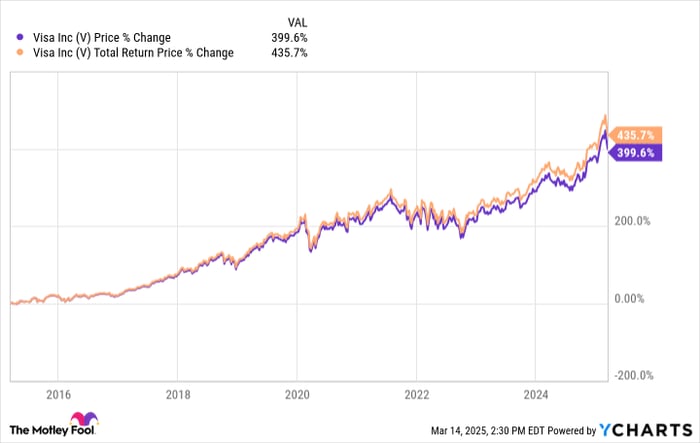

Given that Visa does not produce or oversee the cards and transaction devices, it operates with a minimal-asset, low-risk credit model, generating substantial profit margins. For instance, in 2024, Visa achieved an impressive operating margin of 66%, amounting to revenues totaling $36 billion. Apart from income generated through payment processing, data analysis, and international transactions, Visa derives earnings from supplementary services such as risk management and security solutions. Additionally, Visa provides dividends that have consistently increased over recent years.

Visa's supremacy, brand strength, and network effects are among the factors that have driven the stock's performance previously. With an increasing number of countries transitioning from cash to digital transactions, Visa ought to stay a formidable stock for many years ahead. .

This impressive stock might astonish you.

Could you have imagined that a firm specializing in collecting, managing, and recycling waste could turn into an exceptional performer in the stock market? Stocks known for their lack of excitement frequently provide impressive financial gains, and Waste Management (NYSE: WM) is a classic example.

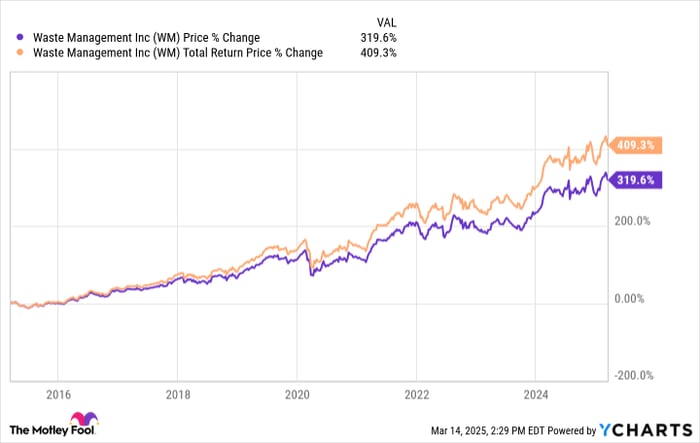

The secret behind Waste Management’s achievements stems from the character of its business, the magnitude and scope of its operations, along with effective management of financial resources. As a frontrunner in the sector, Waste Management benefits accordingly. economies of scale . Since the business of managing waste is immune to economic cycles, the company can generate recession-proof revenues and stable cash flows, which it uses judiciously to grow and reward shareholders.

Waste Management has raised its dividend for 22 continuous years and boosted it consistently over this period. annualized growth rate over a specific period Approximately 6% increase over the last half-decade. This growth in dividends has significantly enhanced overall returns for shareholders throughout these years. The investment has nearly tripled capital in five years and produced astonishing yields in ten years.

Waste Management recently reported solid numbers for 2024 and this year is projecting nearly 18% growth in its free cash flow (FCF) At the halfway point within their forecasted range, here’s the scoop: In November 2024, Waste Management purchased Stericycle, the leading player in medical waste management across North America, for an impressive sum of $7.2 billion. This move introduces a lucrative new sector into Waste Management's business mix and might just become the key driver behind significant expansion. That's why this stands out as a powerhouse stock worth purchasing with plans to keep over the coming ten years.

A quirky stock featuring substantial growth drivers

Given President Donald Trump’s decision to slow down the previous administration's major efforts to support the electric vehicle (EV) industry in the U.S., one might approach this cautiously. EV stocks Currently, though, there’s one electric vehicle company whose stock has captivated my interest for quite some time and still fascinates me: BYD (OTC: BYDDY) , a company that's making waves in the world's biggest electric vehicle market.

The sales of new energy vehicles (NEVs), which include battery electric cars, hydrogen fuel cell vehicles, and plug-in hybrid models, have seen an impressive rise in China. According to recent figures from the automotive sector, these vehicle sales jumped by 35% for the year 2024 and saw almost an 80% increase just last month. In terms of leadership within this segment, BYD holds the top spot with a substantial 29.2% share of the retail NEV market in February, based on information provided by the China Passenger Car Association. Coming at number two is another competitor. Geely It has only approximately a 13% market share.

I initially spotted promise in the BYD stock back in early 2022. and thought it might provide Tesla a chance to compete. In February, as BYD's NEV retail sales surged by 73%, Tesla experienced different fortunes. fell 11% year over year in China.

BYD additionally manufactures commercial vehicles and ranks as the globe’s second largest manufacturer of electric vehicle batteries after CATL. The company has swiftly broadened its international presence over recent years and currently operates in almost 90 nations across various continents including facilities in Asia, Brazil, Hungary, and more. Given all these developments at BYD coupled with soaring sales within China, This stock has the potential to yield enormous profits. in the coming decade.

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on purchasing the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock Here's a suggestion for firms that seem poised for growth. Should you fear missing out on potential opportunities, this might be an ideal moment to purchase shares prior to their inevitable rise. The data clearly indicates this trend:

- Nvidia: If you had put in $1,000 when we increased our investment in 2009, you’d have $315,521 !*

- Apple: If you had put in $1,000 when we increased our investment in 2008, you’d have $40,476 !*

- Netflix: If you had invested $1,000 when we increased our stake back in 2004, you’d have $495,070 !*

Currently, we're sending out "Double Down" alerts for three remarkable firms, and such an opportunity might not arise again anytime soon.

Continue »

*Stock Advisor returns as of March 14, 2025

Neha Chamaria does not hold any shares in the stocks discussed. However, The Motley Fool holds stakes in and endorses Tesla and Visa. They also recommend purchasing shares of BYD Company and Waste Management. Furthermore, The Motley Fool owns shares in disclosure policy .

Post a Comment