Last night, it was cautioned that women might end up working till collapse due to an unexpected increase in the number of individuals employed at the age of 65 and above.

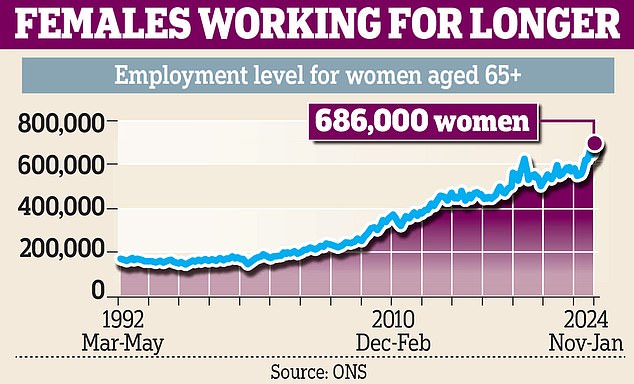

Figures yesterday showed a record one in ten women aged 65 and over are now in work.

Specialists mentioned that numerous individuals can no longer afford retirement following an escalation in the women’s state pension age, aligning it with that of men; this adjustment will be augmented even more for both genders in the future.

This suggests that during a period where numerous individuals might have anticipated engaging in activities such as caring for grandchildren, embarking on cruise trips, or merely relaxing in their gardens, these people continue to set their alarms and head off to work.

Even though numerous individuals express contentment with continuing their work, pension specialists cautioned yesterday that some believe they must persevere despite their circumstances.

According to the Office for National Statistics, the total number of women aged 65 and above who are employed has reached 686,000 following a rise of 135,000 over the last year. ONS ).

This increase represented almost one-fourth of the overall 608,000 job growth during that timeframe.

The former pensions minister Sir Steve Webb, who currently works as a partner at pension consultancy firm LCP, informed The Daily Mail that the problem of individuals unable to afford retirement is growing more urgent.

"It could be that these numbers are like canaries in the coal mine, indicating that we'll see much more of this ahead," he said.

Simon French, the chief economist at City broker Panmure Liberum, stated that the rise in the state pension age for women was probably the main contributor. Increased longevity was another significant factor.

Baroness Altmann, who previously served as pensions minister, highlighted the significant "pension gender gap" during retirement—attributable in part to women typically accumulating smaller pension savings due to spending less time in employment and earning lower wages compared to men—as an additional factor.

According to the ONS data, the number of employed women aged 65 and older increased by 24.4 percent within a year up to January, whereas for men in the same age group, this figure only went up by 3.9 percent. Across both genders combined, people aged 65 and above who were still working saw an overall rise of 11.9 percent—equivalent to an additional 168,000 individuals reaching a historic high of 1.58 million.

This represented the largest percentage increase among all age groups.

The job participation rate for individuals aged 65 and older is now 12.3 percent, marking both an unprecedented level and a doubling compared to figures from two decades back. Specifically regarding elderly women, their employment rate has reached 10 percent—a figure never before documented—up from just 4 percent twenty years prior.

However, men of the same age remain more prone to being employed, with their employment rate rising to 15 percent, up from just below 9 percent during the corresponding timeframe.

In the meantime, the job participation rate for individuals aged between 18 and 24 years old has dropped during the last twenty years, going down from 66 percent to 59 percent.

The rise in employment among older women follows a phase during which the state pension age was raised from 60 to match that of men, which is now 65, and is set to go up further to 66. Ultimately, it will climb even higher to 67 by 2028.

These modifications sparked controversy as many women born in the 1950s contended that they did not receive adequate notification—although a movement led by Women Against State Pension Inequality (Waspi) demanding substantial compensation was dismissed by the government.

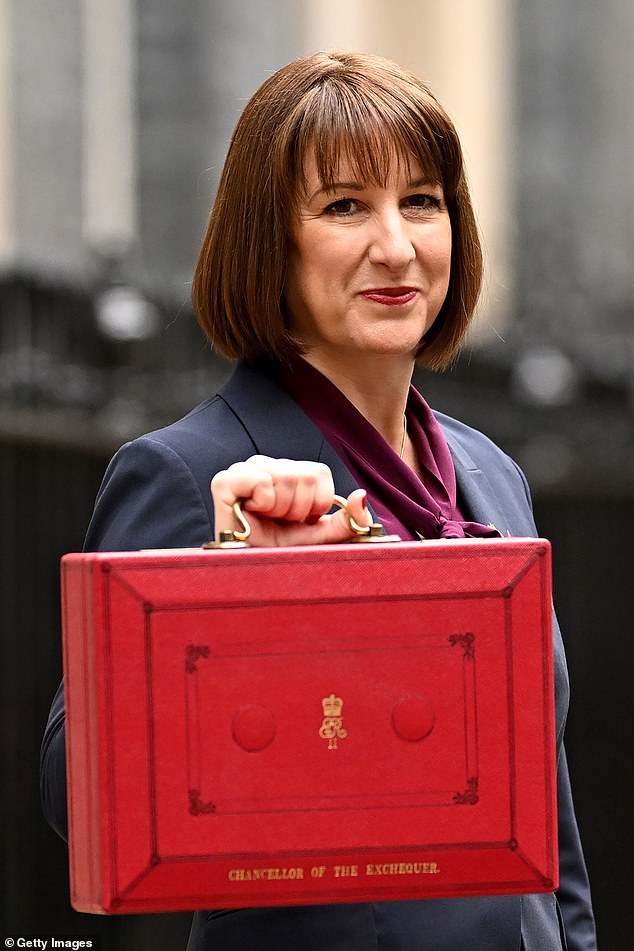

Another blow to older people's incomes came when Rachel Reeves last year decided to remove Winter Fuel Payments for millions of pensioners.

Helen Morrissey, who leads retirement analysis at Hargreaves Lansdown, stated: "Alterations to the state pension age will significantly influence the presence of women above 65 years old in the workforce."

For £11,502 covering the total sum, it serves as the foundation for individuals’ retirement funds, with numerous people finding themselves incapable of retiring until they begin receiving this benefit. Additionally, many retired persons find value in continuing to work—appreciating the social engagement along with the additional earnings that can enhance their daily finances and permit ongoing contributions to their pensions, leading some to opt for part-time employment.

Baroness Altmann stated: "It seems likely that the increase in employment is connected to the absence of pensions for women and the significant disparity in gender pensions."

It works for women who are healthy enough to work and haven’t been impacted by the prevalent age discrimination among employers. However, for others? It would be entirely detrimental.

Danni Hewson from the investment platform AJ Bell commented on these statistics saying, "It’s significant that the former peak was exceeded after the Chancellor announced plans to make the winter fuel allowance subject to means testing, which seems to have motivated additional thousands of women to enter the workforce."

Although financial concerns likely influenced numerous women’s choices to re-enter the workforce or start working for the first time, it's crucial to acknowledge the significant efforts made to enhance employment opportunities for older workers.

'Experience, skills, and life lessons can greatly enhance a work environment. Numerous employers have modified their hiring requirements to make sure they do not disregard candidates who are more seasoned.'

Read more

Post a Comment