You’ve likely come across the saying, “Nothing lasts forever.” This holds true for most facets of life. In the realm of investments, this statement comes pretty close to hitting the mark, though not entirely. Should there be a perpetual option in investing, it would probably be an index fund. Given that individual companies face numerous uncertainties, index funds mirror segments of the overall market through carefully selected stock groupings.

One potential timeless index fund you have the option to purchase and retain it indefinitely is the tactic Vanguard S&P 500 ETF (NYSEMKT: VOO) This ETF is my top choice for an index fund to get exposure to the market. S&P 500 index , potentially the most remarkable market index globally.

Start Your Mornings Smarter! Wake up with Breakfast news In your inbox each trading day. Sign Up for Free »

Below are five arguments for why the Vanguard S&P 500 ETF ought to have a permanent place in your investment portfolio.

1. This offers a simple method for achieving portfolio diversity.

Spreading out investments is among the key aspects of responsible investing. Have you been advised against putting all your eggs in one basket?

The concept remains similar when dealing with an index fund. Despite doing thorough research, unforeseen issues may arise concerning businesses that even careful analysis cannot anticipate. By diversifying your funds among multiple investment options, you ensure that a single error or unfortunate event won’t lead to devastating effects on your overall portfolio.

The Vanguard S&P 500 ETF follows the performance of the S&P 500, which is composed of shares from 500 leading U.S. corporations. This implies that owning even just one unit of the ETF grants you fractional ownership across these numerous firms. Investing in such an S&P 500 index fund represents the simplest method for broadening your investment holdings.

2. It provides access to the S&P 500 index.

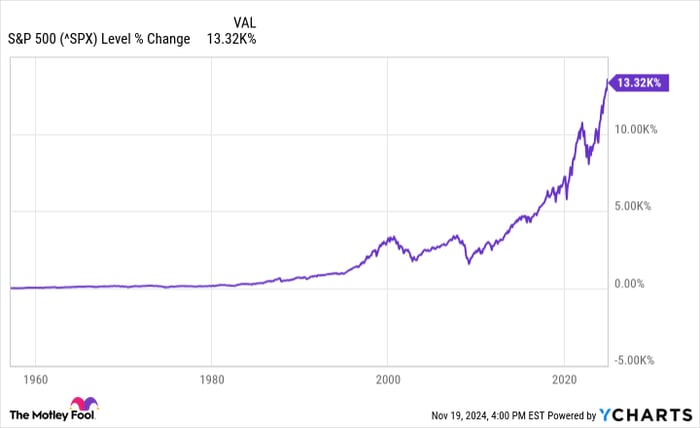

If there’s an index you wish to track, it’s the S&P 500. Having grown to include 500 companies back in 1957, it has generated immense riches for those who invest in it.

The approach is straightforward yet efficient. A panel chooses from leading U.S. firms that meet particular requirements.

The index is adjusted based on market cap, so a company that thrives and grows larger will earn a higher weighting. In doing so, it essentially leans into winning stocks. If a company doesn't perform, it can be dropped from the index and replaced.

It has functioned exceptionally well that most professional investors underperform The S&P 500 over an extended period.

3. It has minimal fees.

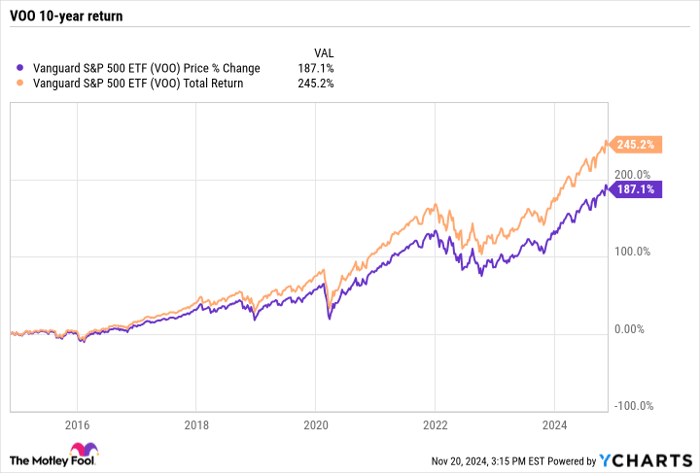

The great aspect of the Vanguard S&P 500 ETF is that owning it comes with minimal cost. Most exchange-traded funds have fees, but this one does not. expense ratio , a charge for the management of the fund. The Vanguard S&P 500 ETF has an expense ratio of merely 0.03%. This implies you would pay $0.30 each year for every $1,000 invested.

The fund’s minimal fees stand out as a clever advantage. Fees tend to differ, however, one general rule is that the more hands-on management a fund has, the pricier the fees become. Although it usually holds true that you get what you pay for in many aspects of life, this isn’t necessarily so when it comes to investment funds. Expensive fees do not ensure superior performance (as most experts underperform compared to the S&P 500 index).

Paradoxically, high fees may cause greater damage than benefit in the long run as they accumulate. Keep in mind: These fees are calculated based on your overall investment, rather than your profits.

4. You can trust Vanguard

You can feel safe putting your money into Vanguard's funds. The company's history goes back to the 1970s. Today, it has over $9 trillion in assets under management. It's the world's largest mutual fund company and the second-largest ETF company behind BlackRock .

Significantly, individuals who invest in Vanguard funds actually become owners of the company rather than owning shares directly in the underlying businesses themselves. Because these investors also possess ownership stakes through their investments in Vanguard’s funds, this alignment fosters shared goals and minimizes potential conflicts. The firm's scale and setup ought to instill assurance in buyers, encouraging them to adopt a long-term investment strategy.

5. This device acts as a compounder, making it ideal for various investment approaches.

Finally, the S&P 500 provides a broad spectrum of investment opportunities, making the Vanguard S&P 500 ETF suitable for nearly every portfolio. As you've observed, the index has shown remarkable growth throughout the years. Interested in dividends? It distributes one with a current yield of 1.3%. Overall, the S&P 500 has consistently delivered substantial returns historically. around 8% annual returns .

Should you put your money into the S&P 500 with past patterns continuing, your money will double roughly every nine years. Thus, $10,000 grows to become $160,000 within 36 years, highlighting the significant effect of compounding when granted sufficient time to operate effectively.

Regardless of whether you’re young and just beginning your financial journey or a retiree looking to extend your savings, the Vanguard S&P 500 ETF should have a place in your investments. It might well be the most worthwhile long-term bet you can make with every single dollar.

Is it wise to put $1,000 into the Vanguard S&P 500 ETF at this moment?

Before purchasing shares of Vanguard S&P 500 ETF, keep these points in mind:

The Motley Fool Stock Advisor The analyst team has recently pinpointed what they think could be the 10 best stocks For investors looking to purchase now... the Vanguard S&P 500 ETF was not among the selections. Instead, the 10 stocks chosen have the potential to generate substantial gains over the next few years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $894,029 !*

Stock Advisor offers investors a straightforward guide to achieving success, featuring advice on constructing a portfolio, periodic insights provided by analysts, along with two fresh stock recommendations every month. Stock Advisor service has more than quadrupled the recovery of the S&P 500 index since 2002*

Check out the 10 stocks here »

*Stock Advisor returns as of November 18, 2024

Justin Pope does not hold any shares in any of the companies listed. However, The Motley Fool does have an interest in and suggests investing in the Vanguard S&P 500 ETF. Additionally, The Motley Fool holds a.position disclosure policy .

Post a Comment