Why might an income-focused investor be hesitant about owning a stock with a 14% dividend yield? It’s quite an alluring figure, considering the typical returns generated by the average investment. S&P 500 (SNPINDEX: ^GSPC) is typically estimated at about 10% annually.

The issue arises because when something seems too good to be true, it usually is. That’s why these two undervalued high-yield stocks present superior income opportunities compared to those offering extremely high yields. AGNC Investment (NASDAQ: AGNC) If you find yourself with $100 ready to invest in stocks at this moment.

Where should you put your $1,000 investment at this moment? Our analysis team has just disclosed their thoughts on what they consider to be the top choices. 10 best stocks to buy right now. Learn More »

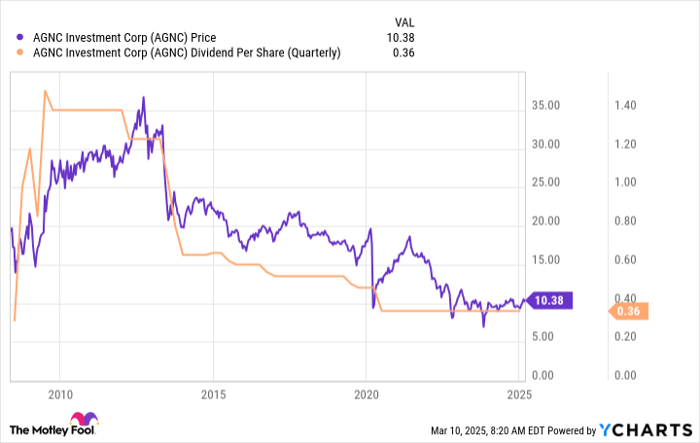

AGNC Investment has disappointed dividend-focused investors.

Occasionally, dividend reductions occur due to valid reasons that could potentially set a company up for a brighter tomorrow. Nonetheless, with AGNC Investment, cutting dividends seems to be an integral aspect of their business strategy. This isn’t really a criticism of AGNC Investment, which is widely recognized as a leader in the mortgage sector. real estate investment trust (REIT). This is merely a factual observation, considering the dividend history.

As the chart shows, AGNC Investment's dividend increased significantly afterwards. IPO , and subsequently embarked on a prolonged downturn. Unsurprisingly, the stock price followed suit. Should you have relied on those dividend payments to cover your living costs, you would have found yourself with reduced income as well as diminished capital.

This wouldn’t be an optimal result for the majority of dividend-seeking investors. Nonetheless, it’s not uncommon for mortgage real estate investment trusts (REITs) to reduce their payouts when market circumstances shift concerning the mortgage-backed securities they purchase. Such investments can be intricate and are influenced by various factors including interest rate fluctuations, shifts in the housing sector, and patterns in mortgage prepayment behaviors, amongst others.

The main point here is that with AGNC Investment, further reductions in dividends seem probable. While there might be hikes as well, if steady payouts are crucial for you, this isn’t the income stock you should include in your portfolio even though it boasts an impressive 14% yield.

Purchase NNN REIT and Federal Realty instead.

If you seek consistent dividends to ensure a reliable income source from your dividend portfolio, then you should focus on examining NNN REIT (NYSE: NNN) and Federal Realty (NYSE: FRT) . NNN REIT is currently providing a dividend yield At approximately 5.5%, this rate is significantly lower compared to what you might receive from AGNC Investment. However, NNN REIT's dividend has seen consistent growth with annual increases over an impressive span of 35 years consecutively. You can rely on this dividend payout.

NNN REIT possesses single-tenant retail properties and employs the net lease approach This indicates that the majority of the operational expenses at each property level fall under the responsibility of the tenants. The primary factor behind the REIT’s achievements lies in its collaboration with expanding retail businesses, executing sale/leaseback arrangements that enable these retailers to generate capital for further expansion. From 2007 onwards, 73 percent of their acquired properties originated from pre-existing partnerships and delivered superior yields compared to those from different ventures.

Even though we can't claim that NNN REIT inherently possesses growth potential, it certainly has an effective strategy for dividend-focused investors. Coupled with this approach is a yield that significantly surpasses what is offered elsewhere. the S&P 500 index , and you might just have a potentially lucrative opportunity on your hands.

Federal Realty stands out as being more dependable compared to NNN REIT, since Federal Realty is uniquely reliable. Dividend King REIT. It has boosted its dividend for an impressive 57 successive years. With a dividend yield of 4.5%, it stands out attractively. Should consistent dividends be important to you, this REIT leaves others behind as the premier choice.

Federal Realty manages strip malls and mixed-use projects. In contrast to similar companies that aim for extensive property collections, Federal Realty prioritizes excellence rather than sheer volume. The company holds approximately 100 locations, each significant and strategically situated. Moreover, most of these sites possess considerable room for enhancement. This serves as a crucial strategy for Federal Realty’s growth, as the firm consistently updates and improves its holdings.

In addition, Federal Realty’s redevelopment expertise also alters its business approach in various manners. This occurs as they plan to offload properties that have achieved their peak worth, often due to enhancements made by the REIT, and utilize those funds to acquire fresh real estate with greater potential for boosting value. For individuals seeking steady dividend payouts, Federal Realty clearly stands out as an excellent choice.

Don’t hesitate — purchase if possible.

Should you seek a dependable equity with substantial dividends, consider incorporating NNN REIT into your investment mix at present due to its collaborative approach. As the share price remains comfortably under $100, acquiring shares should not pose significant difficulty. On the other hand, Federal Realty hovers near the century mark; thus, if funds are limited to around $100, strategic timing will be essential when making a purchase decision. Despite these factors, owing to its standing as a Dividend King,Federal Realty stands out as an exceptionally consistent revenue generator likely deserving of dedicated attention and additional effort from investors.

Don't let this second chance for a potentially profitable opportunity slip away.

Have you ever felt like you've missed out on investing in some of the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock Here's a suggestion for firms that seem poised for growth. Should you fear missing out on potential opportunities, this might be an ideal moment to purchase shares prior to their inevitable rise. The data clearly supports this perspective.

- Nvidia: If you had put in $1,000 when we increased our investment in 2009, you’d have $315,521 !*

- Apple: If you had put in $1,000 when we increased our investment in 2008, you’d have $40,476 !*

- Netflix: If you had invested $1,000 when we increased our stake in 2004, you’d have $495,070 !*

Currently, we're sending out "Double Down" alerts for three amazing companies, and such an opportunity might not come around again anytime soon.

Continue »

*Stock Advisor returns as of March 14, 2025

Reuben Gregg Brewer holds stakes in Federal Realty Investment Trust. The Motley Fool does not have any holdings in the mentioned stocks. The Motley Fool has a disclosure policy .

Post a Comment