(Pawonation.com) -- President Donald Trump and several prominent Senate Republicans continue to search for a resolution as the U.S. government moves closer to hitting its statutory debt ceiling after an inconclusive White House meeting on Thursday.

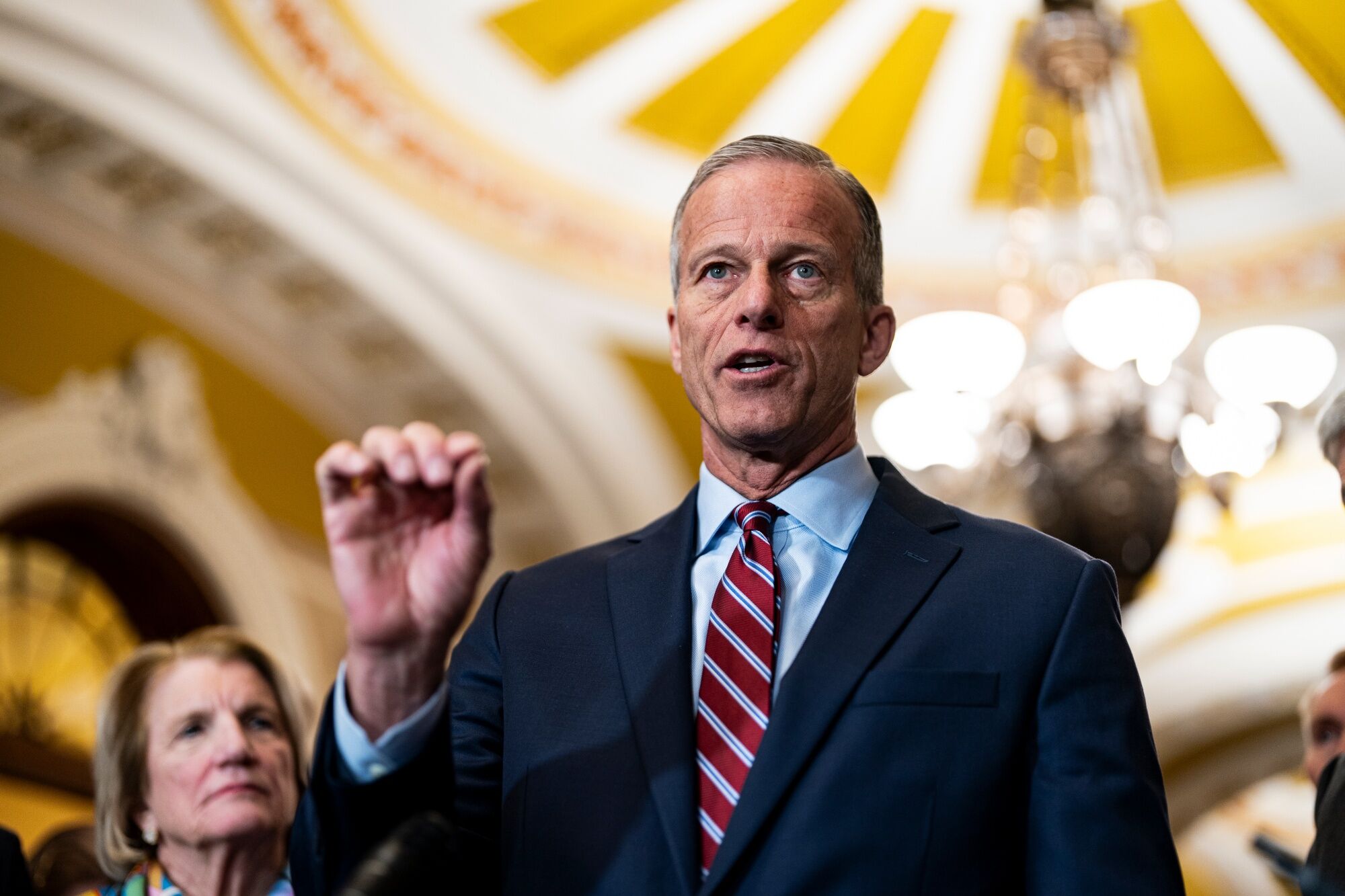

Senators such as Senate Majority Leader John Thune and Finance Committee Chair Mike Crapo explored the possibility of raising the debt limit within the forthcoming tax-and-spending bill that Republicans plan to push through this year. Many experts anticipate that the U.S. could fail to meet its financial obligations at some point during the summer unless the debt ceiling is raised.

"There was no decision reached," Thune stated following the meeting.

The discussions held on Thursday occurred with the shadow of an impending Saturday governmentshutdown looming due to a deadlock in the Senate.

Trump has shown enthusiasm for Congress to greenlight funding before the September 30th deadline for the conclusion of the federal fiscal year, allowing him to shift focus towards his wider legislative priorities. However, by late Thursday, the likelihood of ashutdown was increasing. had ebbed .

The House has proposed raising the debt limit as part of their tax plan, utilizing a method that would necessitate solely Republican support. However, Thune has indicated his preference for addressing the debt ceiling independently, aiming to force Democrats to go on record with their approval of the hike.

During the meeting, Trump reiterated that he favored making tax cuts permanent, Thune said.

Senator Ron Johnson, a Republican from Wisconsin, mentioned that during the discussion they considered limiting the corporate deduction for state and local taxes as a potential funding mechanism for the plan. However, no conclusions were reached on this matter at the time.

The assembly proceeded as the Senate has hit a roadblock on Trump’s primary legislative agenda, a massive bundle of proposals. tax cuts Last month, the House approved an initial budget framework for the legislation. This plan involved reductions to entitlement programs along with increased funding for border security and the military. However, the Senate hasn’t taken action on this proposal as of now.

Senator Chuck Grassley voiced his irritation following the White House meeting. "There was nothing but talking," stated the Republican from Iowa. "Just as we've seen over the past ten weeks."

Thom Tillis from North Carolina stated that the president informed the senators he wished to couple the debt ceiling with the tax plan, allowing it to circumvent the Democratic minority.

"I believe we should address this issue, and I think the President shares this view," Tillis stated. He noted that 11 Republican senators had never supported raising the debt limit before, emphasizing that spending reductions also needed attention. According to him, specific plans were outlined during discussions with Trump.

House Speaker Mike Johnson stated his desire for Congress to finalize the bill by the end of May, whereas Treasury Secretary Scott Bessent indicated on Thursday that he anticipates completion by summertime. To achieve these targets, the Senate needs to act swiftly.

A major obstacle is the cost associated with the proposed tax cuts. Under the House bill, there would be approximately $4.5 trillion in tax reductions spread across ten years, offset by about $2 trillion in spending cuts and an additional $4 trillion rise in the debt limit.

Republican senators have stated that making the reduced individual tax rates permanent and allowing the corporate provisions introduced under President Trump's 2017 legislation to expire by the end of this year is their primary focus for action. According to the draft approved by the House last month, the proposed tax relief plan would extend these measures for just about eight or nine years, without specifying further funding sources beyond identifying potential savings exceeding $2 trillion within ten years.

An alternative approach could involve the Senate employing a budgetary tactic to consider roughly $4 trillion from the extended Trump tax cuts as having no cost since these reductions are already integrated into the current tax laws. However, it remains uncertain whether this "current policy" adjustment complies with the Senate's procedural guidelines.

Crapo stated that the extensive array of tax reductions desired by his Republican counterparts is growing larger. Besides reinstating the modifications from 2017, Republicans are considering eliminating taxes on gratuities, overtime earnings, and inheritances. He mentioned there are suggestions to broaden the capital gains tax incentives for Opportunity Zones as well as raise the $2,000 child tax credit limit.

"Stability is our top focus within the Republican Finance Committee. It's an ongoing challenge, but we are prioritizing this as our number one objective," Crapo stated during a US Chamber of Commerce event on Wednesday.

He mentioned that over 200 tax proposals are pending before the committee for review. This must be aligned with the House Republicans' requirement for corresponding reductions in spending.

"That's quite a challenge," Crapo stated.

Republicans are employing a dual-stage budget reconciliation procedure which enables them to enact the bill solely with Republican support, thus circumventing Democratic involvement. After both the House and Senate concur on an overall budget framework, negotiations over the specific contents of the legislation can commence. This type of bill requires only 50 votes for passage in the Senate rather than the standard 60-vote threshold.

--Assisted by Erin Schilling and Laura Davison.

(Updated with discussions about shutting down in the fourth and fifth paragraphs)

Additional tales of this nature can be found on Pawonation.com

©2025 Pawonation.comL.P.

Post a Comment