Across Warren Buffett's investing career, Berkshire Hathaway Buffett’s investment portfolio has encompassed all three leading U.S. telecommunications firms. The consistent flow of dividend payouts, a reliable income source, along with their moderate valuations might have been factors that attracted Buffett to these particular stocks.

Currently, Berkshire retains just one telecom stock In their collection, it stood out as the top performer. Additionally, this stock is expected to keep climbing as the user base grows and more services are added.

Where should you put your $1,000 investment at this moment? Our analysis group has just disclosed their insights into what they consider to be the 10 best stocks to buy right now. Learn More »

Buffett's telecom stock

Today, T-Mobile (NASDAQ: TMUS) It is the sole telecommunications company within Berkshire's investment portfolio.

To be honest, its two primary rivals, AT&T and Verizon , appear more similar to Buffett stocks at first glance. Each offers a consistent flow of income along with relatively low price-to-earnings (P/E) proportions, and substantial dividend distributions.

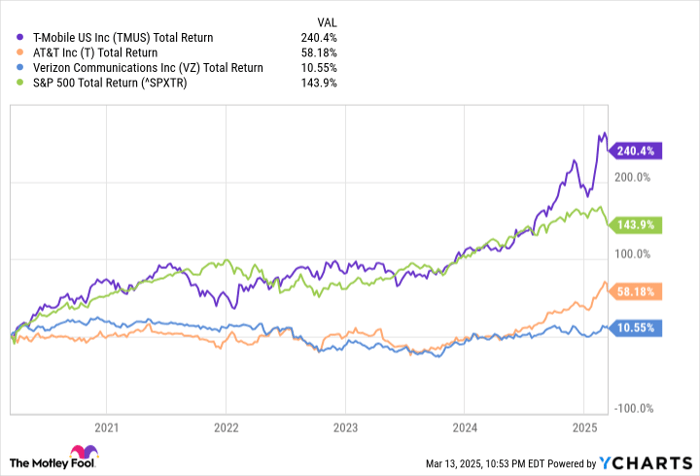

Nevertheless, T-Mobile was the sole stock to achieve returns surpassing those of the overall market over the past five years. This holds true even considering the substantial dividends paid out by its competitors.

For much of that period, T-Mobile distinguished itself by not providing a dividend. However, in late 2023, it initiated its first distribution to shareholders. Currently, its yearly payout stands at $3.52 per share, giving shareholders an attractive return. dividend yield of around 1.3%.

That falls well short of the more lucrative returns offered by its competitors. Nevertheless, even with this lower yield, S&P 500 Its dividend yields have returned to around 1.35%, which is quite close to the average of the broader markets.

T-Mobile's competitive advantage

Furthermore, T-Mobile possesses certain distinctive features. competitive advantages Since its inception in 1994, it has solely operated as a wireless carrier. Consequently, unlike Verizon and AT&T, it doesn’t carry the burden oflegacy expenses related to former landline operations.

At first, the company battled competitors on pricing and gradually captured more market share from established players. Additionally, it expanded via takeovers, purchasing firms like Sprint and UScellular.

The acquisition of Sprint stands out because it provided T-Mobile with significant control over essential wireless spectrum, granting them access to frequency bands that form the backbone of their wireless offerings. Before this, competitors held an advantage in terms of service quality. However, for the past three years consecutively, T-Mobile has topped OpenSignal’s Mobile Network Experience report for overall network performance.

T-Mobile by the numbers

It’s likely that Buffett's team was attracted to T-Mobile's performance as well. In 2024, the company added 6.1 million new postpaid customers, resulting in revenues of $81 billion for the year—a 4% rise compared to the previous year. Although this might not be sufficient to classify it as a high-growth stock, T-Mobile still managed to surpass its primary rivals in terms of performance.

The firm successfully decreased operational costs by over 1%, which significantly enhanced net earnings. As a result, its adjusted metrics showed notable improvement. free cash flow was $17 billion, increasing by 25% compared to the previous year. The report showed $22 billion. cash flow from operations , increasing by 20% compared to the same period last year.

T-Mobile anticipates similar levels of expansion in 2025. It predicts postpaid net customer gains ranging from approximately 5.5 million to 6 million for the year. Additionally, the firm projects net cash generated from operational activities to fall within the range of $26.8 billion to $27.5 billion, indicating a potential rise of around 24% at the mid-point estimate.

The stock’s price-to-earnings ratio stands at 27. Although this is above what its competitors have, it represents a decline from previous figures. Considering the rapid growth of the company’s free cash flow, this valuation could be seen as appealing to potential newcomers investing in the market.

Buffett and T-Mobile

Given its strong business prospects and financial standing, Buffett and his team wisely chose to invest in T-Mobile.

Among the three telecommunications stocks, T-Mobile might seem like the one that aligns least with what is presumed to be Buffett’s preferred investing approach. Nevertheless, he adhered to his track record of making profitable stock selections by opting for the top-performer among them.

Certainly, the firm has established a strong edge through its focus on value, with noticeable enhancements in service quality over the past few years. From a financial standpoint, its free cash flow has seen significant improvement. This makes it an attractive investment for buyers looking at stocks priced reasonably relative to its achievements.

As T-Mobile keeps attracting more subscribers to its network, this trend is expected to result in additional benefits for Buffett's group and those who are emulating Berkshire Hathaway's strategy.

Is putting $1,000 into T-Mobile US at this moment a good investment?

Before purchasing stocks in T-Mobile US, keep these points in mind:

The Motley Fool Stock Advisor The analyst team has just pinpointed what they think could be the 10 best stocks For investors looking to purchase now... T-Mobile US did not make the list. The 10 stocks that were selected have the potential to generate significant gains over the next few years.

Consider when Nvidia created this list on April 15, 2005... should you have invested $1,000 following our suggestion, you’d have $745,726 !*

Now, it’s worth noting Stock Advisor 's overall average return is 830% — significantly surpassing the market with exceptional performance compared to 164% For the S&P 500. Don’t miss out on the updated top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 14, 2025

Will Healy holds shares in Berkshire Hathaway. The Motley Fool has investments in and endorses Berkshire Hathaway. The Motley Fool also suggests buying stocks of T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy .

Post a Comment