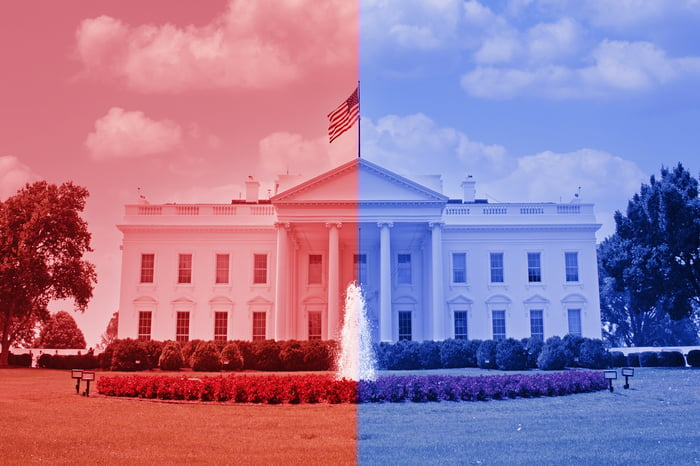

Donald Trump stands out as a highly divisive political leader who entered his term with numerous initiatives. Despite this, each incoming president brings their agenda regardless of how controversial they might be. This aspect is crucial when considering investments, particularly regarding the success or failure of Trump’s specific energy strategy. For those planning to hold onto shares in the energy sector beyond the next four years, evaluating these three major energy corporations would likely prove beneficial.

1. ExxonMobil's dividend has weathered 10 presidential terms

ExxonMobil (NYSE: XOM) has increased its dividend annually for 42 consecutive years. That's just over 10 four-year periods spanning seven presidents, which means ExxonMobil's dividend has been robust through the energy plans of Democrats and Republicans alike. That's not to suggest that the various energy plans haven't mattered or that they don't have an effect on the company's performance -- only that Exxon is built to survive whatever gets thrown at it. That's exactly what a long-term dividend investor should be looking for in an energy stock.

Where to invest $1,000 right now? Our analysis team has recently disclosed their insights into what they consider to be the 10 best stocks to buy right now. Learn More »

The company's strength starts with its business model, which is of the integrated variety. That basically means that it operates in the upstream (energy production), the midstream (energy transportation), and the downstream (chemicals and refining).

Each segment of the broader energy industry operates a little differently. The midstream tends to produce reliable cash flows through the entire energy cycle. The upstream does well when energy prices are high. And the downstream often does well when energy prices are low, given that oil and natural gas are key inputs. This diversification helps soften the peaks and valleys of the volatile energy sector, no matter who is president at any given time.

ExxonMobil also has a very strong balance sheet . The value of this can't be overstated, as it allows management to take on debt during weak patches so that it can keep funding its business and shareholder dividends. When energy prices rise again, as they always have historically, ExxonMobil reduces its leverage in preparation for the next industry downturn. The company's built to survive, and the changing of the guard in Washington isn't going to change much about how ExxonMobil operates over the long term.

2. Chevron resembles ExxonMobil, yet offers a greater dividend yield.

The underlying framework guiding ExxonMobil’s operations is the very same model that Chevron (NYSE: CVX) In certain aspects, they can be used interchangeably. ExxonMobil is a significantly bigger corporation, with a market cap With a value of approximately $486 billion compared to Chevron’s $276 billion based on recent stock prices, ExxonMobil emerges as the larger company when focusing solely on size within the sector. Additionally, another notable distinction is that Chevron has raised its dividend every year for 37 successive years—a period just under one full presidential term—which might not seem like much in perspective. However, both companies exhibit strong consistency regarding dependable dividends.

However, when it comes to dividend yield Chevron clearly takes the lead with its 4.5% dividend yield, surpassing ExxonMobil’s 3.6% by almost an entire percentage point, making it quite significant.

What makes ExxonMobil and Chevron intriguing is their tendency to alternate in terms of performance over periods of time. Currently, ExxonMobil appears to be performing more effectively as a company compared to Chevron, which is encountering several challenges, particularly with an acquisition that isn’t progressing as smoothly as anticipated. Nonetheless, if maximizing the revenue generated from your investment portfolio is your objective, this might make Chevron the preferable choice for steady returns within the energy sector at present.

3. TotalEnergies has strong French roots; incredibly so.

TotalEnergies (NYSE: TTE) It is also a comprehensive energy conglomerate. Differing from ExxonMobil and Chevron, both of which hail from the United States, TotalEnergies originates from France. This distinction impacts various aspects of its operations; notably, a significant portion of its income derives from activities largely unrelated to the American market. Indeed, its extensive global presence, particularly in terms of production outside the U.S., stands as one of the key factors making TotalEnergies attractive. Since it’s not based in the U.S., it has the ability to establish ties with nations that might prove challenging for American companies to navigate smoothly.

Nevertheless, the stronger rationale for favoring TotalEnergies lies in its growing involvement with electricity, particularly including clean energy Similar to wind and solar technologies, it distinguishes itself from its contemporaries through this dedication, serving somewhat like an insurance policy amid the evolving landscape of clean energy. Additionally, just as with oil and natural gas, it allows operations in nations where American rivals would generally be unable to participate.

TotalEnergies has more leverage That’s typical for a large European integrated energy company (they hold more cash to mitigate higher financial risks). Nonetheless, it significantly outperforms its European counterparts when it comes to dividends.

At the peak of the coronavirus pandemic, BP (NYSE: BP) and Shell (NYSE: SHEL) Both reduced their dividends when announcing increased investments in clean energy. In contrast, TotalEnergies maintained its dividend even with similar commitments. Subsequently, BP and Shell have retreated from their initial clean energy objectives, whereas TotalEnergies has accelerated its investment efforts. The company’s integrated power division saw its dividend rise by 17% in 2024, accounting for approximately 10% of its adjusted net operating income.

Many long-term energy investors might find ExxonMobil or Chevron more suitable options, especially when focusing on oil and natural gas exposure. On the other hand, if your preference leans towards investing in an energy company that’s well-prepared for the shift toward cleaner energy sources, then TotalEnergies could be ideal. This choice comes with a substantial 5.7% dividend yield; however, U.S. investors should keep in mind they will owe French taxes on this income. Fortunately, part of these tax payments may be reclaimed during the annual filing process on April 15th.

Long-term investors should not let presidents influence their investment choices.

The investment timeframe on Wall Street appears to be shrinking continuously. For those engaging in day trading—which is generally an unwise strategy for the majority—news regarding Trump's swiftly moving administration will hold significant importance. However, if you're focused on dividends and consider investments over many years rather than mere days, Trump’s administration is simply one more among numerous presidencies.

The aim shouldn’t be to tailor your portfolio specifically for Trump’s impact, whether positive or negative. Instead, you should focus on setting up your portfolio in such a way that it can withstand any scenario, regardless of circumstances. In this regard, ExxonMobil, Chevron, and TotalEnergies stand out as major diversified energy companies with a track record of resilience and consistent returns for their shareholders irrespective of who occupies the presidency.

Is it a good idea to put $1,000 into ExxonMobil at this moment?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia created this list on April 15, 2005... should you have invested $1,000 following our suggestion, you’d have $745,726 !*

Now, it’s worth noting Stock Advisor ’s total average return is 830% — a market-crushing outperformance compared to 164% For the S&P 500 index. Don’t miss out on the most recent top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 14, 2025

Reuben Gregg Brewer has investments in TotalEnergies. The Motley Fool holds positions in and endorses Chevron. The Motley Fool also endorses BP. The Motley Fool has a disclosure policy .

Post a Comment