Stock market downturns frequently present excellent chances to purchase dividend stocks. This occurs because dividend yields tend to increase as stock prices decrease. Therefore, since the stock market has experienced a recent correction, defined as a drop of 10% or greater from its highest point, , dividend yields have now increased. .

One of the simplest methods to take advantage of this chance is to purchase the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) The fund comprises 100 of the leading high-dividend-paying stocks. Its value has been declining along with the overall market, and its yield remains notable. on the rise , it's a no-brainer dividend exchange-traded fund (ETF) to buy right now.

Where should you put your $1,000 investment at this moment? Our analysis group has just disclosed their insights into what they consider to be the top choices. 10 best stocks to buy right now. Learn More »

High-quality, high-yielding dividend stocks

The Schwab U.S. Dividend Equity ETF aims to monitor the performance of the Dow Jones U.S. High-Yield 100 Index This initiative seeks to gauge the performance of equities known for consistently offering high-dividend yields supported by superior financial indicators compared to similar companies. Similar to that index, this ETF includes around 100 stocks. Nevertheless, the top 10 holdings make up over 40% of its total assets. This elite group reads like a list of premier dividend-paying companies.

For example, top-holding AbbVie (NYSE: ABBV) has a terrific record of paying dividends . The pharmaceutical giant has increased its dividend every single year Since its establishment in 2013, it has expanded its distribution by 310% over this timeframe.

The firm presently holds a 3.1%. dividend yield which is over twice the dividend yield of the S&P 500 Recently at about 1.35%, the company has ample financial resources to support its substantial dividend yield. Last year, AbbVie produced $18.8 billion in operating cash flow, which comfortably surpassed its $11 billion expenditure for dividends.

In the meantime, the firm anticipates delivering high-single-digit yearly revenue growth up until at least 2029, propelled by increasing revenues. sales of Skyrizi, Rinvoq, and aesthetics. This growth will allow the firm to keep boosting its dividends.

The rest of its top holdings feature similar characteristics. They also pay high-yielding dividends they've increased at healthy rates for many years. That growth seems likely to continue since they also have strong financial profiles along with their growth potential.

An attractive and growing income stream

Because the Schwab U.S. Dividend Equity ETF's holdings tend to have higher dividend yields, the fund currently offers an attractive income stream. Its distribution yield over the trailing 12 months is 3.6%. Meanwhile, the current yield is even higher at 3.8%, thanks partly to the 7% decline in the ETF's price due to the stock market sell-off .

To provide some context, with this return rate, an investment of $100 in the ETF would generate approximately $3.80 in dividends annually based on today’s distribution amount. In comparison, investing $100 in an S&P 500 index fund currently yields roughly $1.35 per year in dividends.

One of the excellent aspects of this fund is that the revenue it generates gradually increases as the dividend payouts from the associated businesses grow over time.

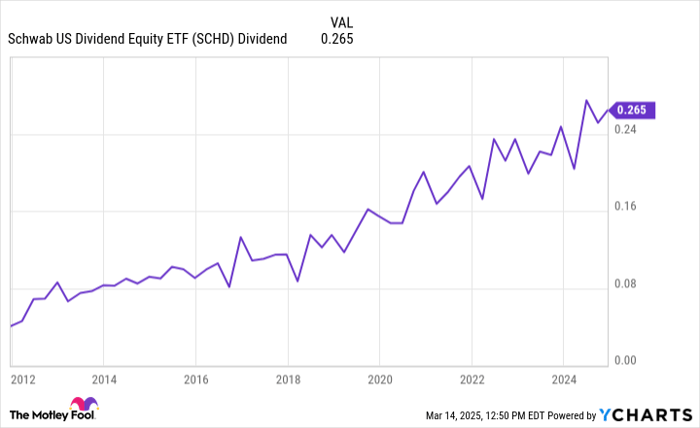

As indicated in the chart, the fund's quarterly distribution payment has increased. rather Over time, steadily increasing each year. Since the fund's launch in 2012, the amount of the quarterly payments has risen by 550%.

Considering the fund’s emphasis on maintaining high-quality dividend stocks with robust histories of increasing dividends, this positive trajectory ought to persist. Consequently, the appealing income yield available to investors at current prices—resulting from the recent drop in value—is likely to become even more enticing as time progresses.

A simple pick for generating income

The Schwab U.S. Dividend Equity ETF is a smart fund to buy right now. The ETF holds 100 top dividend stocks recognized for offering substantial, consistently increasing dividends supported by strong Financial profiles. Given its decreased price because of the downturn in the stock market, it offers a notably more appealing income flow that is expected to keep increasing. in the future .

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $745,726 !*

Now, it’s worth noting Stock Advisor ’s total average return is 830% — a market-crushing outperformance compared to 164% For the S&P 500. Don’t miss out on the updated top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 14, 2025

Matt DiLallo does not hold any shares in the companies listed. However, The Motley Fool does have investments in and endorsesAbbVie. The organization also holds certain positions. The Motley Fool has a disclosure policy .

Post a Comment