Market downturns (defined as a drop of at least 10% from the latest peak) may present an opportunity for those looking for dividends. When share values decrease, dividend yields increase, allowing investors to secure greater returns on numerous investments. top dividend stocks .

I'm taking advantage of the recent dip in the stock market by acquiring additional shares of several top-notch dividend-paying stocks. Recently, among these purchases included Blackstone (NYSE: BX) , Starbucks (NASDAQ: SBUX) , and Verizon (NYSE: VZ) . Here's why I think They are excellent choices for purchasing dividend stocks at this moment.

Where should you put your $1,000 investment at this moment? Our analysis group has just disclosed their thoughts on what they consider to be the 10 best stocks to buy right now. Learn More »

Cashing in on alternatives

The private equity firm Blackstone has seen its value drop by almost 30% since reaching its recent high point. This decline has caused its dividend yield to rise to about 2.8%, which is over twice what it was before. S&P 500 's current yield of 1.3%.

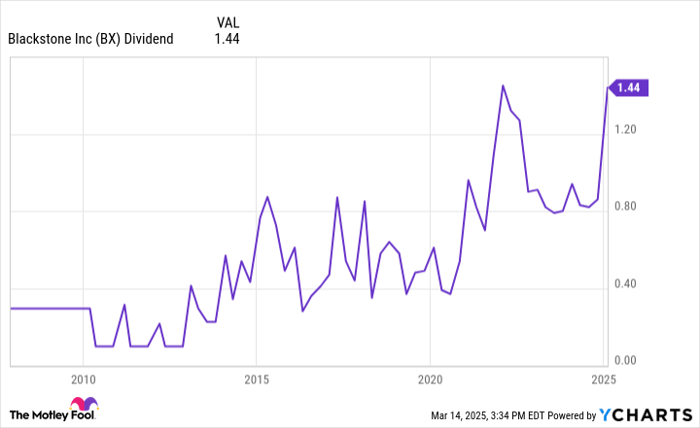

Blackstone is not your usual dividend stock. Unlike many firms that distribute a consistent quarterly dividend, Blackstone opts for an unconventional approach as a major player in alternative assets. Each quarter, they channel much of their available earnings back to shareholders through both dividends and buying back shares. This particular strategy means that their payouts aren’t steady; instead, they can vary considerably from one period to another.

Nevertheless, the payment has been made. On an overall ascending trend In the last fifteen years or so. I expect the rising The trend will persist as Blackstone expands its operations. assets under management (AUM) , revenue from fees, and earnings based on performance.

The driving factor behind this is the anticipation that investors will keep raising their investments in alternative investments I favor private equity, real estate, and credit since these asset classes typically offer greater yields with reduced volatility compared to the public stock and bond markets. As per projections from Preqin, the worldwide alternative investment sector is expected to reach $30 trillion by 2030, an increase from $17 trillion recorded at year-end 2023.

This growth ought to be advantageous for Blackstone's top-tier alternative divisions. As Blackstone’s stock has plummeted due to the market downturn, I could potentially achieve a appealing overall return as its value rebounds and its payout increases.

Sipping again from this source of caffeine which also generates income.

The value of Starbucks' stock has dropped approximately 15% from its peak recently, causing the company's dividend yield to rise to around 2.5%. Ever since starting its dividends, the firm has provided consistently increasing caffeine-infused payouts. Over 14 consecutive years, Starbucks has boosted its distribution, achieving an extraordinary 20% yearly compounded growth rate.

Regardless of its apparent omnipresence, Starbucks stores The business retains significant potential for further growth. With over 40,000 outlets globally, although they have scaled down their earlier ambition to establish an additional 17,000 branches by 2030, the firm remains committed to opening numerous new sites in the future.

In addition, the company wants to boost the profitability of its existing footprint. That's part of a broad turnaround effort by new CEO Brian Niccol to get the brand back to what it does well. These drivers should enable the company to continue increasing its dividend.

Adding on a pullback

Verizon stock has declined by about 6% from its recent peak, which has helped push its dividend yield to 6.2%. The telecom giant's monster payout is on a very firm The firm produced an enormous $19.8 billion in free cash flow following capital expenditures in the previous year. easily Verizon covered the $11.2 billion it distributed as dividends. The company utilized the remaining cash to reinforce its already robust financial position.

Verizon is leveraging its financial stability to acquire Frontier Communications In a $20 billion agreement aimed at speeding up the growth of its fiber infrastructure, this transaction complements Verizon's significant financial commitment to enhancing its fiber networks. 5G These investments ought to increase its cash flow. allowing Verizon plans to keep boosting its dividend. It recently provided its 18th yearly hike in dividends last December, marking the longest such ongoing streak within the U.S. telecommunications industry.

Taking advantage of chances to boost my dividend earnings

Stock market downturns can present excellent chances for boosting my dividend earnings. I took advantage of the recent price drops by increasing my holdings. positions in Blackstone, Starbucks, and Verizon. This will allow me to generate increased earnings from the elevated starting yields along with greater overall returns as their share prices rebound. in the future .

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on purchasing the top-performing stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $315,521 !*

- Apple: If you had put in $1,000 when we increased our investment in 2008, you’d have $40,476 !*

- Netflix: If you had invested $1,000 when we increased our stake back in 2004, you’d have $495,070 !*

Currently, we're sending out "Double Down" alerts for three remarkable firms, and such an opportunity might not arise again anytime soon.

Continue »

*Stock Advisor returns as of March 14, 2025

Matt DiLallo holds stakes in Blackstone, Starbucks, and Verizon Communications and currently holds the following options: short March 2025 $80 put options on Starbucks. The Motley Fool has investments in and endorses Blackstone and Starbucks. They also recommend shares of Verizon Communications. Additionally, The Motley Fool owns some options related to this setup. disclosure policy .

Post a Comment