The benchmark S&P 500 The index begins 2025 with a challenging performance, showing a year-to-date decline exceeding 5%. Nonetheless, certain stocks are defying the current market volatility.

Shares of Zscaler (NASDAQ: ZS) The value has increased by almost 10% this year, largely due to a positive financial statement for its fiscal second quarter of 2025 (ending January 31). This firm specializes in cybersecurity software and is seeing significant interest from companies striving to manage their way through a progressively perilous digital landscape.

Where should you put your $1,000 investment at this moment? Our analysis team has just disclosed their thoughts on what they consider to be the 10 best stocks to buy right now. Learn More »

Even though Zscaler’s stock has recently shown strength, it is still down by 45% from its peak reached during the technology boom of 2021; therefore, there is still time for potential buyers to invest. Furthermore, The Wall Street Journal tracks 45 analysts who cover Zscaler stock, and the overwhelming majority have assigned it the highest possible buy rating -- and not a single analyst recommends selling.

Zero-trust cybersecurity is essential for contemporary businesses.

In today’s economy, companies must function online if they aim to reach their maximum possible sales and access the international talent pool. However, possessing a digital presence It also entails considerable dangers since companies face cyber attacks round the clock, every single day.

For instance, remote employees may introduce substantial security risks. Since managers cannot observe them directly, it becomes challenging to determine if login attempts to the organization’s network are legitimate or if user credentials have been compromised. Zscaler was among the first to advocate for a zero-trust approach. cybersecurity The architecture aims to reduce these risks through its Zero Trust Exchange platform, which views each login attempt with suspicion. It examines not just the employee’s credentials but also their location and the device being used to verify their identity.

However, it doesn't stop there. The Zero Trust Exchange only connects each employee to the digital applications they need to complete their jobs, so even if a malicious actor breaches the login stage, they still won't have access to the entire corporate network.

Zscaler introduced a new segment to its platform last year called Zero Trust Branch. It runs every factory, warehouse, and device used within an organization through the Zero Trust Exchange, effectively treating it as hostile and forcing it to operate in isolation from a cybersecurity perspective. That means even if one of those assets succumbs to an attack, the chances of it spreading are practically nil.

The Branch product helps Zscaler realize its goal of creating a "Zero Trust Everywhere" world, where every facet of an organization runs through its exchange and is fully secured. At the end of the fiscal 2025 second quarter, Zscaler said 130 of its customers have adopted the Zero Trust Everywhere approach, and it wants to triple that number over the next 18 months.

Zscaler is nearing GAAP profitability.

Zscaler produced $647.9 million in revenue. revenue during its fiscal 2025's second quarter, which was a 23% increase from the year-ago period. It was also comfortably above the company's guidance of $634 million, which prompted management to increase its full-year forecast for fiscal 2025 by $14 million to $2.647 billion (at the midpoint of the range).

The outcome was particularly noteworthy since Zscaler has been diligently controlling expenditures to enhance profitability, indicating reduced investment in growth-focused outlays such as advertising. Actually, during the initial six months of fiscal year 2025, the firm expanded its overall revenue. operating expenses by merely 19%, which was significantly slower compared to its revenue increase of nearly 25% over the same timeframe.

As a result, more money flowed to Zscaler's bottom line. It still generated a net loss -- based on generally accepted accounting principles ( GAAP ) -- of $19.7 million in the first half of fiscal 2025, but that was a 68% reduction from the $61.9 million net loss it delivered in the prior-year period.

However, Zscaler was actually profitable to the tune of $251.8 million during the period on a non-GAAP basis, which leaves out single-instance and non-monetary expenses such as stock-based compensation That marked a 35.1% rise from the first half of fiscal year 2024, underscoring the significant advancement the company is achieving in terms of profitability.

This represents a significant change from Zscaler’s previous focus on growth at all costs in 2021. Although the firm experienced rapid revenue expansion during that period, this came with substantial financial outflows due to their intense expenditure tactics. Now adopting a more measured stance towards both development and profit generation, Zscaler is establishing an enterprise structure designed for enduring stability and consistent value delivery to shareholders.

Wall Street is very bullish on Zscaler's stock

The Wall Street Journal tracks 45 analysts who cover Zscaler stock, and 27 of them have assigned it the highest possible buy rating. Three others are in the overweight (bullish) camp, while the remaining 15 recommend holding. No analysts recommend selling.

Their average price target for the stock is $236.50, which implies a modest potential upside of 18% over the next 12 to 18 months. The Street-high target of $270 is a little more juicy, pointing to a potential upside of 35% instead.

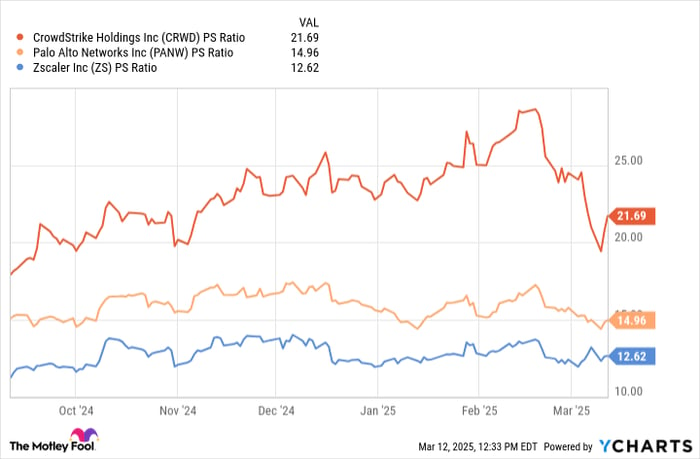

But Zscaler stock could do even better over the long term, thanks to a combination of its attractive valuation and the company's strong growth. The stock currently trades at a price-to-sales (P/S) ratio of 12.4, which is a discount to some of the other cybersecurity leaders like Palo Alto Networks and CrowdStrike :

Moreover, Zscaler values its total addressable market at $96 billion, so it has barely scratched the surface of that opportunity based on its current revenue. According to Cybersecurity Ventures, cybercrime could cause a whopping $10.5 trillion in damage to the global economy during 2025, so demand for advanced protection is only going to grow from here.

When Zscaler reached approximately $370 per share amid the technology investment boom in 2021, it was clearly overpriced. However, the firm has substantially increased its revenues since then, which suggests it may regain those heights should it maintain its present growth path. Therefore, including this stock in a well-rounded investment portfolio could prove quite beneficial.

Is it wise to put $1,000 into Zscaler at this moment?

Before purchasing stocks in Zscaler, keep this in mind:

The Motley Fool Stock Advisor The analyst team has just pinpointed what they think could be the 10 best stocks for investors to buy now… and Zscaler wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $745,726 !*

Now, it’s worth noting Stock Advisor ’s total average return is 830% — a market-crushing outperformance compared to 164% For the S&P 500 index. Don’t miss out on the most recent top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 14, 2025

Anthony Di Pizio does not hold any shares in the stocks discussed. However, The Motley Fool holds stakes in and endorses CrowdStrike and Zscaler. They also recommend purchasing shares of Palo Alto Networks. The Motley Fool owns shares in Palo Alto Networks as well. disclosure policy .

Post a Comment