Everyone knows about the S&P 500 Index (SNPINDEX: ^GSPC) , which is likely the most well-known market indicator globally? However, have you ever come across the Dow Jones U.S. High-Yield 100 Index ? Probably not.

This is the index located at the back of the document. Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) And with its appealing 3.5% dividend yield, here’s how this index functions and the reasons it renders this ETF particularly enticing when your investment budget is under $500 at present.

Where should you put your $1,000 investment at this moment? Our analysis team has just disclosed their thoughts on what they consider to be the top choices. 10 best stocks to buy right now. Learn More »

What is the function of the Dow Jones U.S. Dividend 100 Index?

The Dow Jones U.S. Dividend 100 Index zeroes in on dividend stocks. However, these aren’t ordinary dividend stocks. When constructing its portfolio, the primary criterion for inclusion is that each company must demonstrate at least ten successive years of yearly dividend hikes.

This concentrates the portfolio on firms that have demonstrated their robustness because typically, weaker enterprises do not often achieve such success. (The index also eliminates real estate investment trusts (REITs) as they would lead the portfolio due to their specific structure aimed at distributing substantial dividends.)

Certain indices might halt at this stage, but the Dow Jones U.S. Dividend 100 Index proceeds with an additional filter. This index generates a combined score based on factors such as cash flow relative to total debt. return on equity , dividend yield, and a company's five-year growth rate of dividends.

Every one of these elements serves a specific role. The ratio of cash flow to total debt assesses financial resilience. Return on equity acts as an indicator of corporate excellence. Dividend yield straightforwardly reflects the anticipated earnings for an investor. Meanwhile, the five-year dividend growth rate essentially blends multiple aspects; primarily though, it aids in confirming that investors are purchasing stakes in firms likely to provide returns over time.

Approximately 100 firms with the top overall scores make it into the index and their representation is based on their market capitalization. The portfolio composition gets refreshed every year, ensuring that only the most suitable choices remain part of the index. Consequently, investors receive all these updates at an extremely low cost. expense ratio of just 0.06%.

How do you buy into this index?

To invest in this particular index, your sole option is to purchase shares of the Schwab U.S. Dividend Equity ETF. With each share priced at approximately $30, entry into this investment requires a fairly modest amount of capital. However, when considering the returns, what kind of performance should one anticipate? For openers, there’s an approximate dividend yield of 3.5%, yet this merely scratches the surface of its potential.

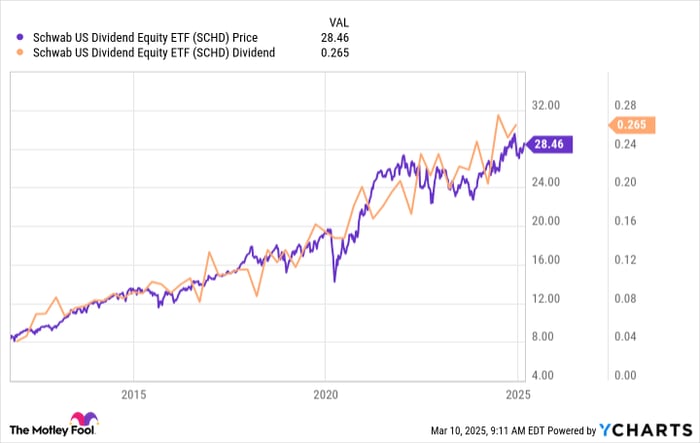

Observe that the price of the Schwab U.S. Dividend Equity ETF has shown an upward trajectory over time. This indicates that shareholders' investments have appreciated in worth. However, considering its emphasis on dividends, it may generally underperform compared to others. the S&P 500 index's performance. But then, the S&P 500 index is only offering a 1.2% dividend yield. Most income investors probably wouldn't mind this trade-off.

Next, look at the dividend line. It has also moved higher over time, which makes sense since the increase in the value of the ETF means there's more capital to invest in dividend-paying stocks. Given the pass-through nature of ETFs, the dividend varies from quarter to quarter. But overall, dividend investors have not only seen their capital increase; they also have seen their income stream increase. That'll be a win/win for most dividend investors.

The best part of the story

For those focused on dividends who prefer not to immerse themselves deeply in market activities, the Schwab U.S. Dividend Equity ETF offers an excellent choice. This fund mirrors the performance of the Dow Jones U.S. Dividend 100 Index, which essentially automates much of what investors typically aim to achieve with individual high-yield equities—namely, backing solidly managed firms with robust financials capable of paying consistent dividends. Consequently, this ETF should appeal straightforwardly to many dividend enthusiasts seeking minimal hassle.

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on purchasing the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock Here's a suggestion for firms that seem poised for significant growth. Should you fear missing out on potential gains, this might be an ideal moment to purchase shares before opportunities become scarce. The statistics clearly indicate as much.

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $315,521 !*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $40,476 !*

- Netflix: If you had invested $1,000 when we increased our investment in 2004, you’d have $495,070 !*

Currently, we're sending out "Double Down" alerts for three amazing companies, and such an opportunity might not come around again anytime soon.

Continue »

*Stock Advisor returns as of March 14, 2025

Reuben Gregg Brewer The Motley Fool does not hold any shares in the stocks mentioned. The Motley Fool has no position in any of the stocks discussed. The Motley Fool maintains no stake in these companies. disclosure policy .

Post a Comment