The stock market experienced another decline on Friday following China’s response to President Donald Trump's tariffs by implementing a 34% tax on all American products. The S&P 500 dropped by 6%, marking its largest single-day decrease since the onset of theCOVID-19 pandemic five years prior.

Check out the tale featured in the video up top.

China responded with their own tariffs matching those imposed by President Trump, yet he stated on social media, “China handled this incorrectly; they were spooked.”

According to Steve Cochrane, the chief APAC economist at Moody's Analytics, from an investor’s perspective, this trade war seems likely to last longer and become even tougher.

Experts suggest this might lead to increased costs and reduced exports from the U.S., particularly affecting the country’s farming industry. Nevertheless, Secretary of State Marco Rubio supported the president's tariffs, asserting that both the market and companies would adapt accordingly.

"After understanding the regulations, people adapt accordingly. Therefore, it’s not accurate to claim that entire economies are collapsing. Instead, financial markets are experiencing downturns since these markets reflect the stock values of nations whose current economic systems may be detrimental to the interests of the United States,” stated Rubio.

President Trump highlighted on social media that he had a "highly fruitful conversation" with Vietnam, which informed him that they wish to reduce their tariffs to zero should an agreement be reached.

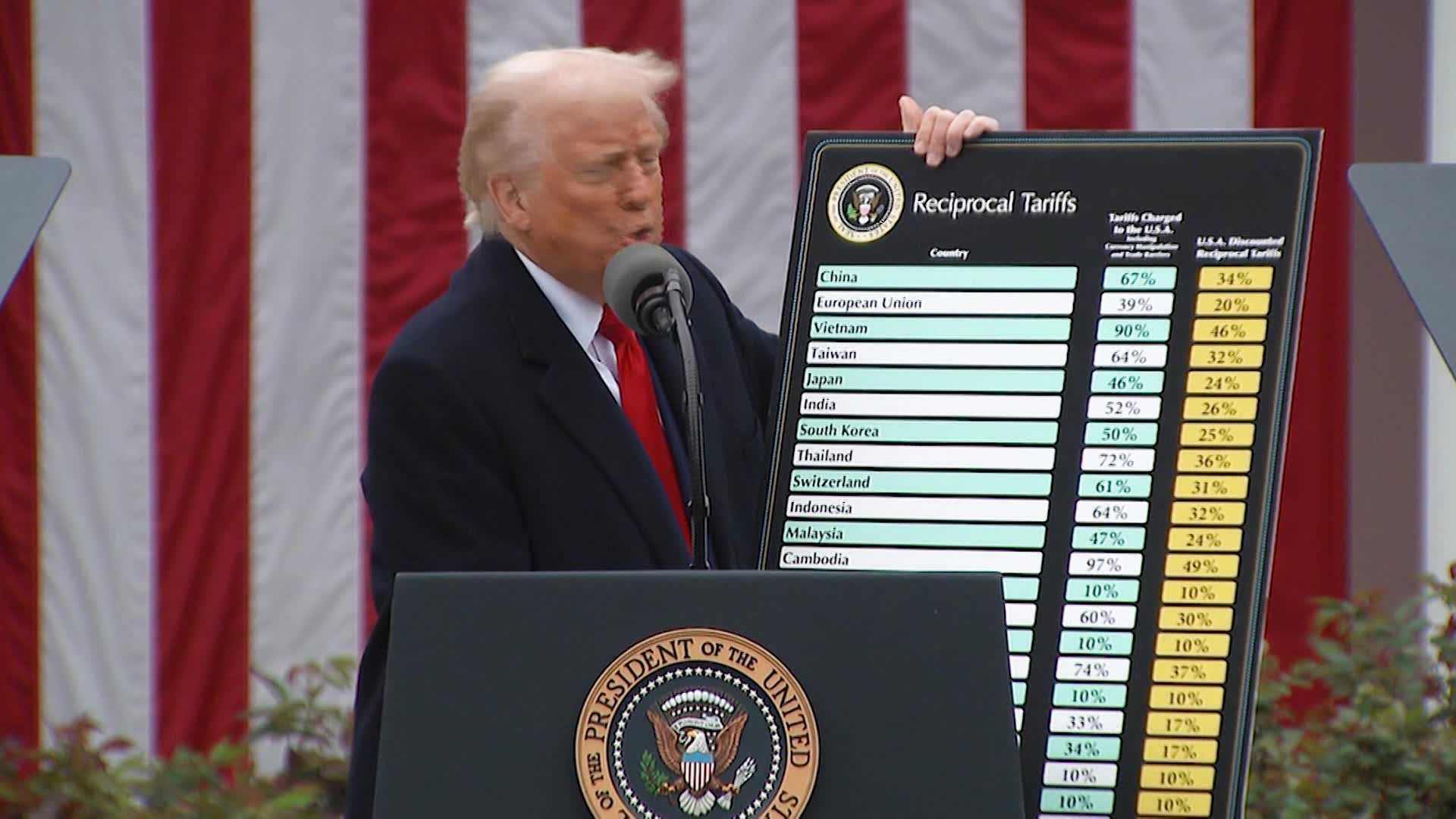

This arises as doubts emerge about how the so-called "reciprocal" tariffs were determined. The president stated that the U.S. would impose duties on countries at half the rate those nations levy against the U.S.; however, our associates at FactCheck.org indicate that this claim is deceptive.

For instance, the White House's "reciprocal" tariff chart indicates that the European Union imposes a 39% tariff on goods from the U.S., whereas data from the World Trade Organization show the actual rate to be only 2.7%.

Cochrane stated that they performed a straightforward mathematical operation by calculating the U.S. trade deficit per country and then dividing it by the overall value of American imports, normalization-wise. Cochran emphasized that this method does not consider tariffs at all.

The president additionally addressed investors today, stating, “My policies remain constant; now is an excellent opportunity for wealth accumulation.” Nonetheless, economists argue this increases ambiguity, leaving investors uncertain about whether he will pursue deal-cutting measures or continue imposing tariffs.

China's new taxes will come into play early next week.

READ MORE: The stock market takes a dive following China’s retaliation against Trump's tariffs.

CHECK OUT WPTZ: Stay updated with the newest news from Plattsburgh and Burlington today. Check out the top stories, and access the most recent weather forecast online whenever you want.

Post a Comment