- PODCAST: Catch up on all the top stories, such as Trump revoking Biden's pardons and Governor Newsom's surprising announcement about statues.

Donald Trump demanded the Federal Reserve "Do the Right Thing" and trim down interest rates after Chair Jerome Powell mentioned they planned to stay consistent .

The president thinks these measures will facilitate the shift to his tariff policies. Canada and Mexico Retaliatory tariffs will be implemented by the United States starting April 2.

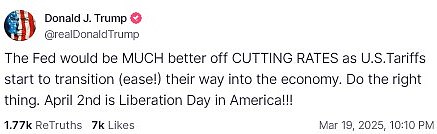

On Wednesday evening, Trump criticized Powell and the Federal Reserve in a post made on Truth Social.

The Federal Reserve should consider lowering interest rates as U.S. tariffs gradually impact the economy. Make the correct decision. April 2nd marks Liberation Day in America!!!

On April 2nd, Trump will enact 'reciprocal tariffs' to counterbalance the import duties and non-tariff obstacles imposed by every trade counterpart nation.

Reducing interest rates makes it less expensive for companies to obtain loans, which is important because it also decreases financing costs for typical American citizens. This allows them to allocate more funds towards purchasing products and services.

Trump believes that this combined with his tariff plans will make the American economy soar to new heights.

Powell mentioned on Wednesday that they intend to reduce interest rates two times before the end of the year, though not in anticipation of Trump's suggested 'Liberation Day.'

Since assuming power, Trump has worked to significantly alter international trade patterns, implementing a 20% hike in import taxes on products from China and levying 25% tariffs on items coming from Canada and Mexico. adhere to the trade regulations of the United States-Mexico-Canada Agreement .

He has likewise reinstated the full 25% tariff on steel and aluminum imports from around the world.

Currently, the implications of Trump's tariff proposals remain ambiguous. However, their impact will largely hinge on the speed at which any inflation stemming from these tariffs permeates the economy and whether inflation expectations continue to be firmly controlled.

He mentioned that the robust inflation figures over the past two months came as a surprise, possibly because consumers accelerated their purchases in anticipation of impending tariffs.

The Federal Reserve aims to track these impacts; however, numerous distractions arise due to tariff announcements and their subsequent delays.

The Federal Reserve has held interest rates consistent, yet it still intends to reduce them twice later in 2025.

But officials said they inflation is still not under control, and they also revised down growth forecasts - in both cases blaming Trump's policies such as tariffs.

The central bank's decision maintains the reference rate within the range of 4.25 percent to 4.5 percent , as analysts expected.

Powell suggested that, notwithstanding concerns about inflation Due to tariffs, the Federal Reserve intends to proceed with reducing interest rates two times this year as planned.

This cheered investors and led to an increase in US stock indices during the afternoon session, with the S&P 500 climbing over one percent. This boost benefits 401(k) plans, which have suffered from significant drops in share values in recent weeks.

Although the Federal Reserve interest rate does not directly impact interest rates for loans, credit cards, and mortgages It has a significant impact on them.

"We shouldn't rush into changing our policy position," Powell stated following the interest rate announcement.

Federal Reserve officials revised their projections for inflation upwards this year, anticipating that their favored gauge of price hikes will likely rise more than previously anticipated. conclude the year at 2.7 percent compared to the 2.5 percent expected in December . Both are above the central bank´s 2 percent target.

Along with increasing inflation projections, the central bank now anticipates slower economic growth compared to their earlier expectations.

The Fed also anticipates that the unemployment rate will rise slightly, reaching 4.4 percent by the close of this year.

The forecasts highlight the challenging position the Federal Reserve might face this year: High inflation generally prompts the Fed to maintain a higher key interest rate, or potentially increase it further.

Conversely, diminished economic expansion coupled with increased joblessness might prompt the Federal Reserve to decrease interest rates in order to encourage greater lending and consumption, thereby stimulating the economy.

This marks the second consecutive time that the Federal Reserve has done so. maintained its interest rate around 4.3% As the central bank has stepped back to assess the effects of the Trump administration’s policies on the economy.

Experts predict that tariffs may probably lead to an increase in inflation, albeit perhaps only for a short period. However, various measures like deregulation might reduce expenses and help decrease inflationary pressures.

Powell stated that increasing inflation expectations are largely attributable to tariffs, which serve as a significant driver.

President Trump's tariff headlines drove the S&P 500 into a correction The territory experienced this situation last week. This occurs when stock prices drop more than 10 percent below their peak values.

Powell explained the Federal Reserve’s ‘wait and see’ stance by noting that the incoming administration's shifts in policies related to trade, immigration, fiscal matters, and regulations could collectively influence economic conditions.

"It will be the overall impact of these policy adjustments that matters for the economy and the direction of monetary policy," Powell stated.

The mix of increased inflation alongside slower economic growth might result in a feared era of stagflation.

Economists have intensified their alerts about a potential approaching recession as U.S. citizens lag in automobile financing. Moreover, consumers' long-term inflation expectations skyrocketed to their peak levels since the 1990s.

Federal Reserve officials are carefully monitoring indicators of Americans' inflation expectations, which surged in a survey published only recently.

Inflation expectations — basically an indicator of how concerned individuals are about rising prices worsening — hold significance for the Federal Reserve as they have the potential to become a reality.

If people expect higher inflation, they may take steps, such as accelerating purchases, that can push prices higher.

High-end and budget retailers alike have cautioned that shoppers are becoming increasingly wary, anticipating price hikes due to tariffs. Following a significant decline in retail sales during January, there was only a slight increase recorded in the previous month.

Read more

Post a Comment