Creating passive income is key to achieving financial freedom. This approach yields consistent monetary inflows without needing direct participation, enabling investors to concentrate on various life pursuits or seize further prospects. Many aim to construct an investment collection that provides sufficient passive earnings to sustain their livelihoods perpetually.

Introducing Vanguard exchange-traded funds (ETFs), the creation of an investment icon. John Bogle . These ETFs offer a powerful combination of broad diversification and rock-bottom fees, making them ideal vehicles for long-term wealth-building and income generation. Vanguard's approach to investing, pioneered by Bogle, emphasizes low-cost, passive strategies that have revolutionized the investment landscape.

Read More: Earn up to $845 cash back this year just by changing how you pay at Costco! Learn more here.

Vanguard ETFs stand out in the financial world due to a distinctive combination of attributes. Generally, these funds exhibit lower turnover ratios than most actively managed options, which significantly cuts down on taxes for investors. Alongside this tax advantage, numerous Vanguard ETFs have shown remarkable increases in dividends over time from their launch. Together, these factors highlight the superior caliber of assets held within these funds.

Furthermore, Vanguard’s strategy for managing passively structured funds guarantees that these exchange-traded products mirror their respective benchmarks accurately. By employing this method, they enhance operational efficiency without sacrificing the straightforwardness favored by retail investors. Consequently, this creates an effective financial tool that merges extensive market coverage with the economical advantages of passive management strategies.

Another critical advantage of Vanguard's low-cost ETFs is their reliability. Thanks to their highly diversified portfolios and high-quality holdings, these ETFs are unlikely to suspend their cash distributions, even during economic downturns. This reliability is a significant benefit over individual stocks, which may cut or eliminate dividends during challenging times.

Let’s delve into three Vanguard exchange-traded funds (ETFs) that could offer lifelong passive income, with each providing a distinct strategy for dividend investment.

A low-cost core holding

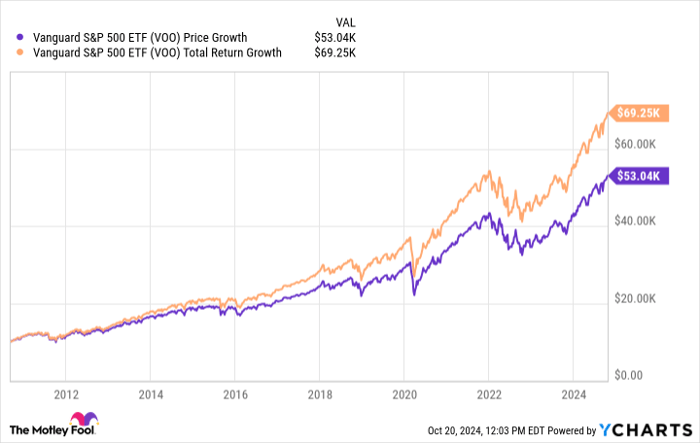

The Vanguard S&P 500 ETF (NYSEMKT: VOO) reflects the effectiveness of the benchmark S&P 500 Index comprising 500 of the biggest U.S. firms. This ETF features an exceptionally low expense ratio of just 0.03%, enabling investors to keep more earnings. Despite a seemingly moderate 30-day SEC yield of 1.23%, the real advantage of this fund stems from its strong prospects for expansion.

Since its launch in 2010, the fund has seen a remarkable 13.4% compound annual growth rate ( CAGR This impressive chart demonstrates the effectiveness of putting money into top-tier, dividend-increasing firms over an extended period. For instance, had you invested $10,000 when the fund started, with all dividends being reinvested and without accounting for taxes, your total value would now stand at approximately $69,250.

Comprehensive U.S. market exposure

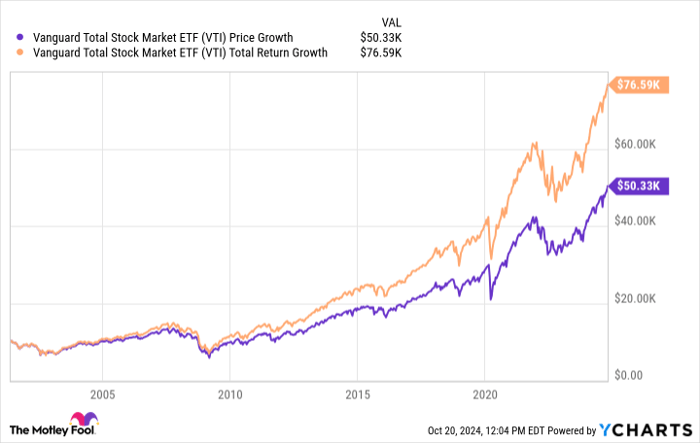

The Vanguard Total Stock Market Index Fund ETF Shares (NYSEMKT: VTI) offers investors broad exposure to the entire U.S. stock market, encompassing small-, mid-, and large-cap stocks. Matching its S&P 500 counterpart, it sports a minimal expense ratio of 0.03%, maximizing investor returns.

While its 30-day SEC yield of 1.22% closely mirrors the S&P 500 ETF, this fund's true value lies in its long-term performance and diversification across the entire U.S. market. Since its inception in 2001, the fund's distributions have grown at an annual rate of 5.05%.

This consistent expansion equates to substantial gains over an extended period. An initial outlay of $10,000 when the fund first opened, including dividend reinvestment and disregarding any potential taxes, has flourished into $76,590 as of now.

The fund's performance has exceeded that of the mentioned S&P 500 ETF because of its more extensive history. It offers investors an easy method to achieve broad exposure to the complete U.S. equity market through one investment vehicle.

Focus on high-yield stocks

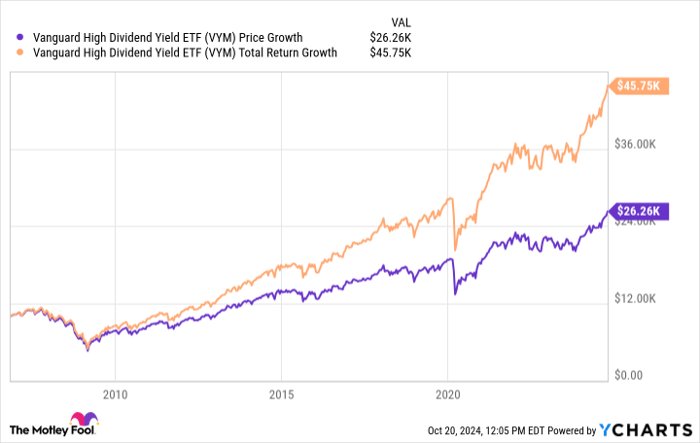

For those investors focusing on generating immediate income, the Vanguard High-Dividend Yield Index Fund ETF Shares (NYSEMKT: VYM) presents a compelling option. This ETF targets stocks with above-average dividend yields, resulting in a higher 30-day SEC yield of 2.65%.

While its expense ratio is slightly higher at 0.06%, it remains remarkably low compared to actively managed funds. The fund's strength lies in its income generation and growth potential.

Since its 2006 inception, the ETF's distributions have grown at an annual rate of 9.18%. Although its earnings growth rate of 10.6% is lower than the broader market ETFs, it compensates with a higher current yield.

To illustrate its performance, a $10,000 investment at the fund's launch, with dividends reinvested and assuming no tax liabilities, would have grown to $45,750 today. This growth showcases the fund's potential for both income and capital appreciation over time.

The strength of hands-off management

Each of the three ETFs profits from Vanguard’s passive management strategy, ensuring they mirror their corresponding indices accurately. This minimalist method streamlines investment processes for those looking to generate passive income. These ETFs also boast minimal turnover ratios—2.2% for both the Vanguard S&P 500 ETF and the Vanguard Total Stock Market ETF, with the Vanguard High Dividend Yield ETF at 5.7%. Such figures contribute significantly to their overall tax efficiency.

These Vanguard exchange-traded funds (ETFs) demonstrate the possibility of generating increasing passive income over time. They stand out in the world of ETFs due to their extensive diversification, very low costs, and hands-off management style.

Where should you put your $1,000 investment at this moment?

Whenever our analysis group shares a stock recommendation, it might be worth paying attention. After all, Stock Advisor’s The overall average return stands at 820%, which significantly surpasses the S&P 500’s performance of 172%. *

They just revealed what they believe are the 10 best stocks for investors to buy right now…

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

George Budwell holds stakes in the Vanguard S&P 500 ETF. The Motley Fool has investments in and endorses the Vanguard S&P 500 ETF, Vanguard Total Stock Market ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool possesses a disclosure policy .

Post a Comment