- The recent downturn in the Nasdaq has sparked concerns about a sudden reversal in technology stocks after years of artificial intelligence enthusiasm.

- This has sparked comparisons to the dot-com bubble, which caused the Nasdaq to plummet by 78% when it burst in 2000.

- Financial experts advise Business Insider that significant takeaways from the year 2000 could be crucial for investors to consider as they plan ahead for 2025.

It has been 25 years since the dot-com crash, and investors are once again facing worries about a potential market downturn. tech bubble reaching unsustainable levels.

On March 10, 2000, the Nasdaq Composite reached its peak, followed by a downturn that lasted for almost three years. This led to a significant decline of about 78%, hitting bottom in October 2002.

Skip ahead 25 years, and investors are questioning if the rise of artificial intelligence has propelled markets back into bubble territory.

Given that the Nasdaq has dropped 13% over the past month, the situation looks concerning. recent stock sell-off Has left several investors questioning whether this marks the start of a prolonged and more agonizing market downturn following years of excessive optimism. Does that sound familiar?

These insights from investors and analysts shared with Business Insider highlight key takeaways from the tough experiences during the dot-com bust.

Understand the stages of a market cycle

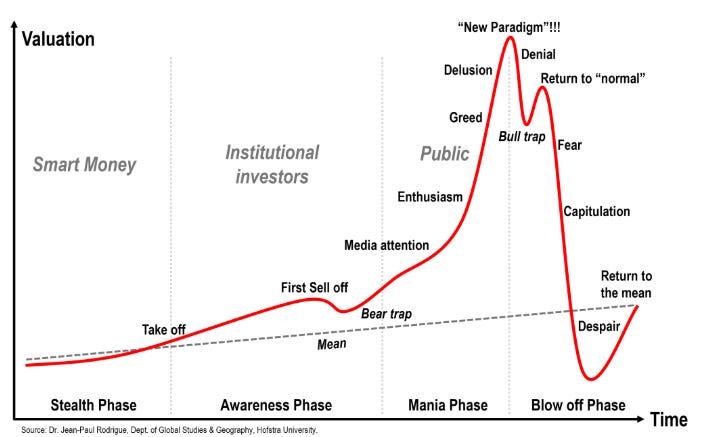

Regardless of whether you examine the Dutch tulip mania from the 1630s or the Japanese property boom from the 1980s, every market cycle goes through similar stages that investors ought to recognize.

Ted Mortonson, the managing director and tech specialist at Baird, explained to BI that these distinctive stages consist of exuberance, calmness, worry/fear, panic, and finally capitulation.

Mortonson stated that until every stage of the cycle has been encountered, lows cannot be reached.

Mortonson suggests that we are currently within the concern/fear phase of the present market cycle, indicating that further declines may be imminent.

"Mortonson stated we plan to significantly reduce our holdings starting in early April due to concerns over slowing growth." He further noted that the first quarter’s profit reports would likely include numerous disappointments along with reduced forecasts, all under conditions of continuing ambiguity surrounding President Donald Trump's trading strategies.

Valuations matter

As stated by Giuseppe Sette, who serves as the president of Reflexivity, investors ought to keep a close watch on stock valuations.

The P/E ratio for future earnings of the company is S&P 500 It reached approximately 24 times its value around the year 2000. Recently, it came close to these figures once more but swiftly pulled back, reaching a peak of roughly 23 times its value in 2021 and again earlier this year.

"Both the dot-com bubble and the year 2021 demonstrate that the market can only support up to a forward P/E ratio of 23x-24x," Sette explained to BI through an email. "Whenever the P/E reaches 22.5x, a downturn is imminent," he added.

Although the present stock market doesn't abound with unprofitable businesses as it did back in 2000, it still houses numerous such firms. trading at extreme valuations —but it also boasts considerable earnings to support those valuations.

A good example is Nvidia , the quintessential example of the AI surge. The semiconductor giant has increased its net income by 788% Since 2023, it has been trading at a slight discount compared to the S&P 500 even though it is expected to increase its revenue by 75% this year.

The technology is real

Although stock market valuations may become excessive, this is typically justified by strong fundamentals.

The internet’s potential has turned out to be genuine, and artificial intelligence likely holds similar promises, as per Sette.

Sette mentioned that the dot-com bubble accurately foresaw the potential of technology but occurred approximately 10-15 years prematurely. He noted that now these technological advancements have finally arrived. In just 18 months, there has been a significant surge in AI capabilities, with developments progressing at an increasingly rapid pace. He pondered where AI might stand in half a decade and how close it may come to achieving Artificial General Intelligence (AGI). Sette suggested that perhaps this era truly marks a distinct turning point.

Many internet-era businesses capitalized on the potential of the World Wide Web during the dot-com boom but eventually collapsed. However, think about how major success stories from that period—such as Amazon and eBay—not only endured but have continued to flourish over 25 years later.

Perhaps it isn't a bubble after all?

Brian Belski, the chief investment strategist at BMO and the sole Wall Street analyst who has continually produced research since the dot-com era, asserts that the stock market is far from entering a bubble phase.

Belski told Business Insider that just because asset prices rise does not necessarily indicate it's a bubble,

The game is still in the early stages. Back in 1999/2000, we were engaging in wild activities. For instance, corporations were acquiring others using questionable stocks.

That sort of behavior isn't happening right now despite the AI boom.

The IPO market Has remained inactive for years and has displayed minimal indications of revival, suggesting that the bubble hasn't started inflating yet.

"Inside the bubble, everyone seems to be making money," Belski stated.

Why isn’t AI considered a bubble at present? To understand this, you should step back and reflect. Are financial institutions profiting from it? Do we observe significant initial public offerings or follow-on offerings? Is there notable consolidation occurring through mergers and acquisitions?

Belski thinks the word "bubble" is thrown around too often on Wall Street, and it's had a negative impact on investors' psyche for years.

"For about three decades now, the market has experienced significant declines, and each time it starts to rise again, investors claim 'It’s going to drop soon! It’s going to drop soon.'" This contrasts sharply with the situation in the late 1990s," according to Belski.

If you liked this tale, make sure to follow Business Insider on MSN.

Post a Comment