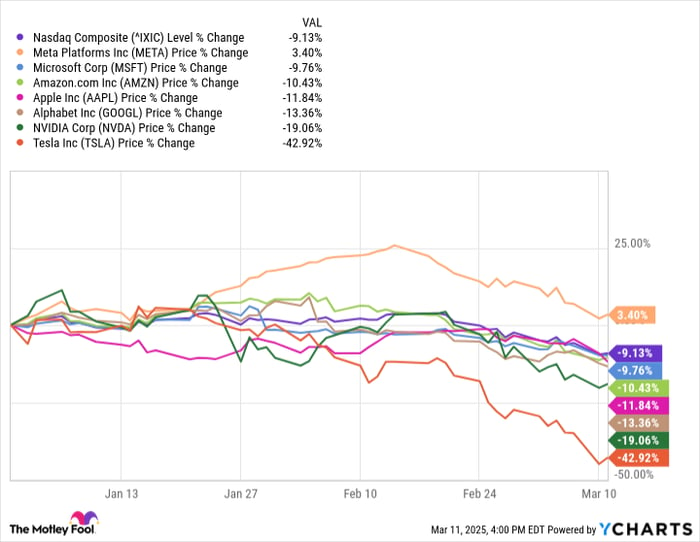

Just under three months ago, the Nasdaq Composite reached its peak ever, maintaining a strong performance that started two years prior. From that point onward, the index has declined more than 13%, with a decrease of 9% just this year, placing it in correction territory as of March 11th.

As an index that is significantly affected by large tech stocks It comes as no shock that numerous prominent technology stocks have experienced similar declines this year. Magnificent Seven " stocks, Meta Platforms is currently alone at the top in greens hit for this season.

Where should you put your $1,000 investment at this moment? Our analysis group has recently disclosed their insights into what they consider to be the 10 best stocks to buy right now. Learn More »

Although numerous technology firms handling artificial intelligence While AI has seen spikes in interest over the past few years, this enthusiasm—or the absence of it—has also resulted in considerable declines, mirroring the corrections observed in the Nasdaq.

As mentioned, an under-the-radar AI stock appears more attractive amid the recent market downturn: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) If you have $1,000 set aside for investment, this might be an opportune moment to think about purchasing some stocks with a long-term perspective.

One of the major pioneers in artificial intelligence is Alphabet.

Over the last few years, numerous businesses have invested heavily in artificial intelligence initiatives. However, Alphabet stands out as a leader in this field with its pioneering work in AI technology. The corporation operates a dedicated AI research entity known as DeepMind, which concentrates on advancing sophisticated AI systems. machine learning algorithms, deep learning frameworks, and reinforcement learning systems.

Despite not receiving as much focus from other Alphabet entities, DeepMind plays an essential role in advancing artificial intelligence for Alphabet. Its creation of the AI model known as Gemini stands out among these contributions. By being at the forefront with substantial internal R&D capabilities, Alphabet holds a significant advantage over larger technology firms that are either developing their own infrastructures or depending on external solutions like third-party models provided by others. OpenAI ).

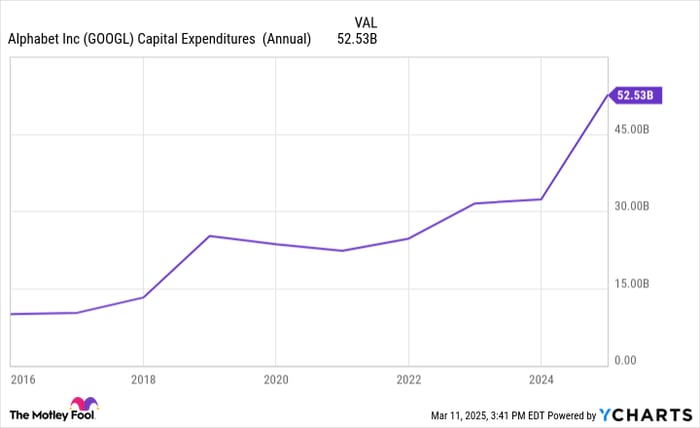

In 2024, Alphabet invested $52 billion on capital expenditure And intends to allocate approximately $75 billion for expenditure this year. Considering the significance of artificial intelligence projects for its expansion, one can reasonably anticipate that a substantial portion of this budget will be directed towards such efforts. Although increased financial investment does not ensure positive outcomes, it demonstrates the organization’s readiness to commit considerable resources to what appears to be its most rapidly expanding area.

If Alphabet were to spend $75 billion, it would represent over a 130% jump from its expenditure in just 2023.

Google Cloud is becoming increasingly popular.

Cloud computing represents a rapidly expanding market sector for numerous major technology firms, such as Alphabet. The company’s Google Cloud platform comes in behind Amazon Web Services (AWS) and Microsoft In terms of market share, Azure has shown significant growth; over the last seven years, its market share has increased twofold to reach 12%, placing it comfortably ahead of the company in fourth place. Alibaba Cloud.

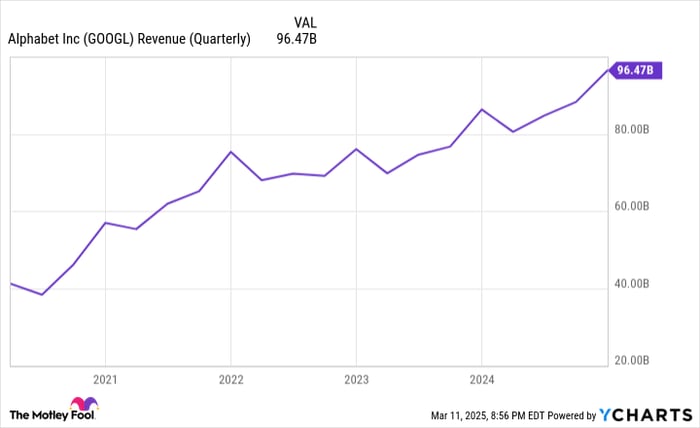

During the fourth quarter (Q4), Google Cloud generated $12 billion in revenue, marking a 30% increase from the previous year. According to Alphabet’s CEO, Sundar Pichai, the increased demand for their AI-driven Google Cloud services clearly demonstrates strong market interest, with solid financial gains backing this observation.

Google advertising should be Alphabet's bread and butter for the foreseeable future, but Google Cloud is beginning to hold more of its own weight. Of Alphabet's $96.5 billion in revenue in Q4, Google Cloud accounted for 12%. Just five years ago, it only accounted for around 5%.

Over time, Alphabet must rely less on Google Search, which accounted for 56% of its Q4 earnings. While it will continue to be a significant profit driver for Alphabet, it’s positive to see Google Cloud stepping in to help shoulder more of the burden.

Google's parent company appears to be looking like a good deal.

Several months back, Alphabet's shares were being traded at almost 34 dollars. times its earnings It was less pricey than other Magnificent Seven stocks, yet not quite bargain-bin cheap.

Following recent declines, Alphabet's stock is now considered a bargain, trading at slightly above 20 times its earnings, which is considerably lower than its typical average.

Investing in stocks always involves risks, particularly with high-growth tech stocks such as Alphabet. Nevertheless, purchasing Alphabet now poses significantly lower risk compared to what it did a few months back.

Who can say whether prices will keep falling? However, if you’re thinking of putting money into Alphabet, this might be an opportune moment to start purchasing some stock. If you worry about additional decreases, think about dollar-cost averaging and spreading out your investment to help offset volatility.

Is it a good idea to put $1,000 into Alphabet at this moment?

Before purchasing shares in Alphabet, keep this in mind:

The Motley Fool Stock Advisor The analyst team has recently pinpointed what they think could be the 10 best stocks For investors looking to purchase now... Alphabet was not included. The 10 stocks selected have the potential to generate significant gains over the next few years.

Consider when Nvidia created this list on April 15, 2005... should you have invested $1,000 following our suggestion, you’d have $745,726 !*

Now, it’s worth noting Stock Advisor 's overall average return is 830% — significantly outperforming the market by a large margin compared to 164% For the S&P 500. Don’t miss out on the updated top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 14, 2025

John Mackey, who previously served as CEO of Whole Foods Market—an entity now owned by Amazon—is part of The Motley Fool’s board of directors. Additionally, Randi Zuckerberg, formerly responsible for market development and communications at Facebook and sibling to Meta Platforms CEO Mark Zuckerberg, also sits on The Motley Fool’s board. Furthermore, Suzanne Frey, an executive at Alphabet, is included among the members of The Motley Fool’s board of directors. Stefon Walters holds stakes in Alibaba Group, Apple, and Microsoft. The Motley Fool has interests in and advocates for Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. They also recommend shares of Alibaba Group and suggest the following options: purchasing long-term $395 call options on Microsoft for January 2026 and selling short-term $405 call options on Microsoft for the same month. Additionally, The Motley Fool holds a position in these companies. disclosure policy .

Post a Comment