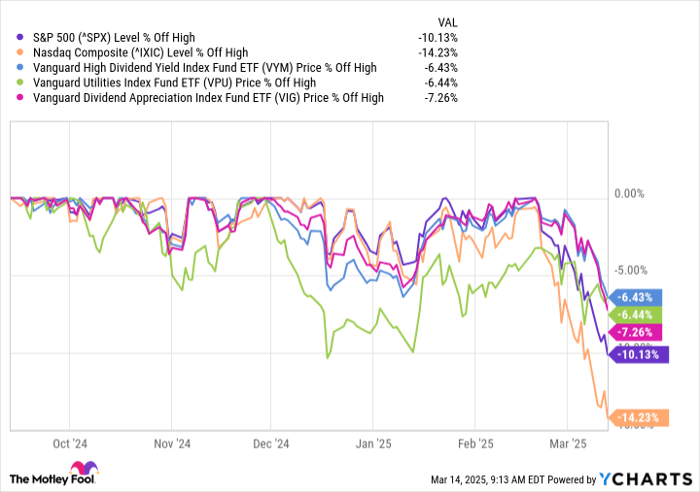

Recently, the stock market has moved into a correction phase, defined as a drop of 10% or greater from the most recent high point. S&P 500 (SNPINDEX: ^GSPC) simply reached that stage on Thursday, while the Nasdaq Composite (NASDAQINDEX: ^IXIC) has now dropped over 14% from its peak. Numerous stocks have fallen even further.

Stock market volatility can be disconcerting. Although investors aren't able to completely To safeguard their portfolio against volatility, they can adopt measures to mitigate the impact. One approach is to invest in dividend stocks , which have traditionally shown lower volatility compared to the overall market.

Where should you put your $1,000 investment at this moment? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Buying an exchange-traded fund ( ETF It is an excellent method to widely invest in stocks that pay dividends . The leading ETF provider, Vanguard, presents numerous excellent choices, including the Vanguard High-Dividend Yield Index Fund ETF (NYSEMKT: VYM) , Vanguard Utility Index Fund ETF (NYSEMKT: VPU) , and Vanguard Dividend Appreciation Index Fund ETF (NYSEMKT: VIG) As illustrated in the chart, this group of three ETFs has not been affected as severely as the overall market during the present downturn:

Increased earnings to soften the impact

The Vanguard High Dividend_yield ETF aiming to assess the profitability of investments in stocks high dividend yields in comparison to the overall market. Firms offering larger dividend yields provide investors with a greater foundational return, which can help offer a little extra padding against fluctuations.

The current dividend yield of this ETF stands at 2.5%, which is almost twice as high as the S&P 500’s rate, approximately 1.3%.

Over an extended period, stocks offering higher dividend yields generally surpass market performance more frequently. Data provided by Wellington Management and Hartford Funds indicates that firms with greater dividends tend to do better. dividend payout ratios (indicating typically greater returns) surpassed the overall market 70% of the time between 1930 and 2023. This success rate was more frequent compared to what dividend stocks with smaller payout ratios achieved. We're seeing that outperformance during the current correction as the value of higher-yielding dividend stocks have performed better compared to the overall market.

Producing revenue and consistent earnings

The Vanguard Utilities ETF seeks to mirror the returns of utility stocks . These firms offer utilities like electricity, natural gas, water, along with various other services to both residential customers and commercial entities. tend to generate very stable earnings. The demand for these crucial services generally remains quite stable. In the meantime, governmental authorities establish the prices.

That stability enables utilities to pay higher-yielding dividends. For example, the Vanguard Utilities ETF currently yields almost 2.9%. That higher-yielding payout provides investors with a very solid base return.

Meanwhile, utilities offer solid growth prospects. Power demand is surging due to catalysts like electric vehicles, the electrification of everything, and artificial intelligence (AI) data centers. That's enabling utilities to build more renewable energy generating capacity, natural gas power plants, and electric and natural gas transmission and distribution infrastructure. Those investments are growing the sector's earnings, which should enable these companies to increase their higher-yielding dividends in the future.

These dividend stocks yield higher returns

Higher-yielding dividend stocks can be excellent long-term investments. However, the best dividend stocks are those that grow their payouts. They have historically produced the highest total returns with the lowest levels of volatility.

From 1973 onwards, stocks of companies that regularly increased their dividends or started paying them out have provided an average yearly return of 10.2%, accompanied by a figure of 0.89. beta (a typical indicator of volatility) as per information provided by Ned Davis Research and Hartford Funds. This approach significantly outperforms businesses that did not alter their dividend strategy (yielding a 6.7% return with a 1.02 beta coefficient), along with an Equal-Weighted S&P 500 Index which returned 7.7% with a beta of 1.0.

The Vanguard Dividend Appreciation ETF concentrates on firms known for increasing their dividend payouts each year . While the fund's holdings have a lower dividend yield (currently 1.7%), they have excellent dividend growth track records.

For instance, the largest single investment of the fund is Broadcom (NASDAQ: AVGO) At 5.3% of its assets, this semiconductor and software powerhouse exhibits an underwhelming dividend yield of 1.2%. Nevertheless, Broadcom excels notably in boosting its dividends consistently. Last year, it augmented its distribution by a further 11%, thus prolonging its record-breaking streak of yearly dividend hikes to fourteen consecutive years. Over this timeframe, the firm has magnificently escalated its payouts by a staggering 8,330 percent.

Dividend earnings can assist in softening the effect of volatility

The fluctuation of the stock market may be challenging for numerous investors to tolerate. Although you cannot remove this volatility entirely from your investment mix, incorporating additional dividend-paying stocks might help mitigate its effects.

Vanguard simplifies this process through ETFs such as the Vanguard High Dividend Yield ETF, Vanguard Utilities ETF, and Vanguard Dividend Appreciation ETF. These exchange-traded funds can add greater dividend income, reduce volatility, and offer the possibility of achieving higher returns for your investment portfolio over an extended period.

Is it advisable to put $1,000 into the Vanguard High Dividend Yield ETF from Vanguard Whitehall Funds at this moment?

Before purchasing shares in Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF, keep these points in mind:

The Motley Fool Stock Advisor The analyst team has recently pinpointed what they think could be the 10 best stocks For investors looking to purchase now... Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF did not make the list. Instead, the 10 stocks selected have the potential to generate substantial gains over the next few years.

Consider when Nvidia created this list on April 15, 2005... should you have invested $1,000 following our suggestion, you’d have $745,726 !*

Now, it’s worth noting Stock Advisor 'S total average return is 830% — significantly outperforming the market by a large margin. 164% For the S&P 500 index. Don’t miss out on the most recent top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 14, 2025

Matt DiLallo holds stakes in Broadcom. The Motley Fool has investments in and endorses Vanguard Dividend Appreciation ETF and Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF. Additionally, The Motley Fool recommends shares of Broadcom. The Motley Fool has a disclosure policy .

Post a Comment